We specialize in crypto bookkeeping

CryptoBooks calculates taxes on your cryptocurrencies with 100% accuracy: the peace of mind of correct tax reports, ready to be delivered directly to your accountant.

Connect and reconcile all your platforms and wallets

You can connect all your platforms and wallets to CryptoBooks: the already integrated connections are over 500, both through APIs and CSV. And if you don't find what you're looking for, you can create custom connections.

Check and verify your crypto transactions

Get help from guided procedures or our Artificial Intelligence: you'll resolve discrepancies easily and quickly.

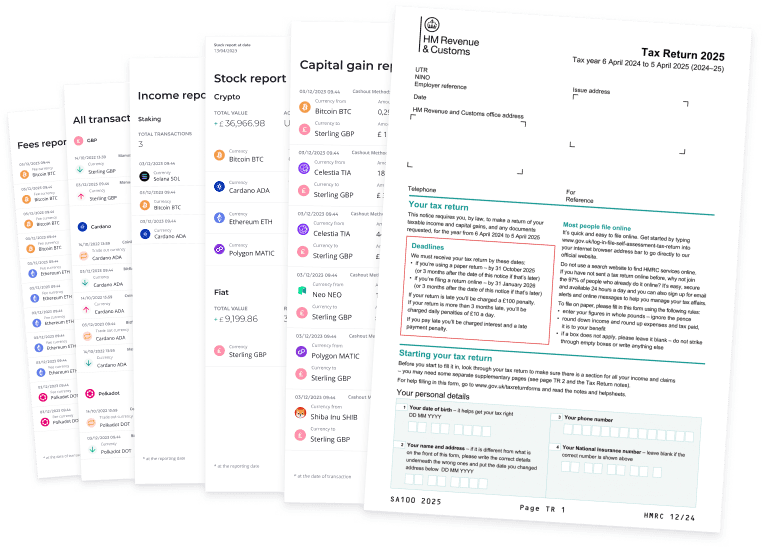

Download your crypto tax reports

Export your crypto tax reports to submit to your accountant or use directly for your Tax Return. They are the most accurate reports you can obtain and are 100% compliant with the latest UK laws.