The challenge of crypto capital gains

Calculating crypto capital gains isn’t as simple as subtracting your buy price from your sell price.

HMRC requires you to use specific rules such as share pooling and same-day matching, making it difficult to know exactly how much tax you owe.

If you trade frequently across multiple wallets and exchanges, tracking your gains manually quickly becomes overwhelming, leading to errors, missed transactions, and unexpected tax bills.

The risk of manual calculations

Many investors waste hours building spreadsheets, only to end up with numbers they can’t fully trust.

A single mistake can inflate your capital gains or leave them underreported, both of which create problems.

The uncertainty adds stress and makes tax season a frustrating experience year after year.

The smarter way to handle crypto capital gains

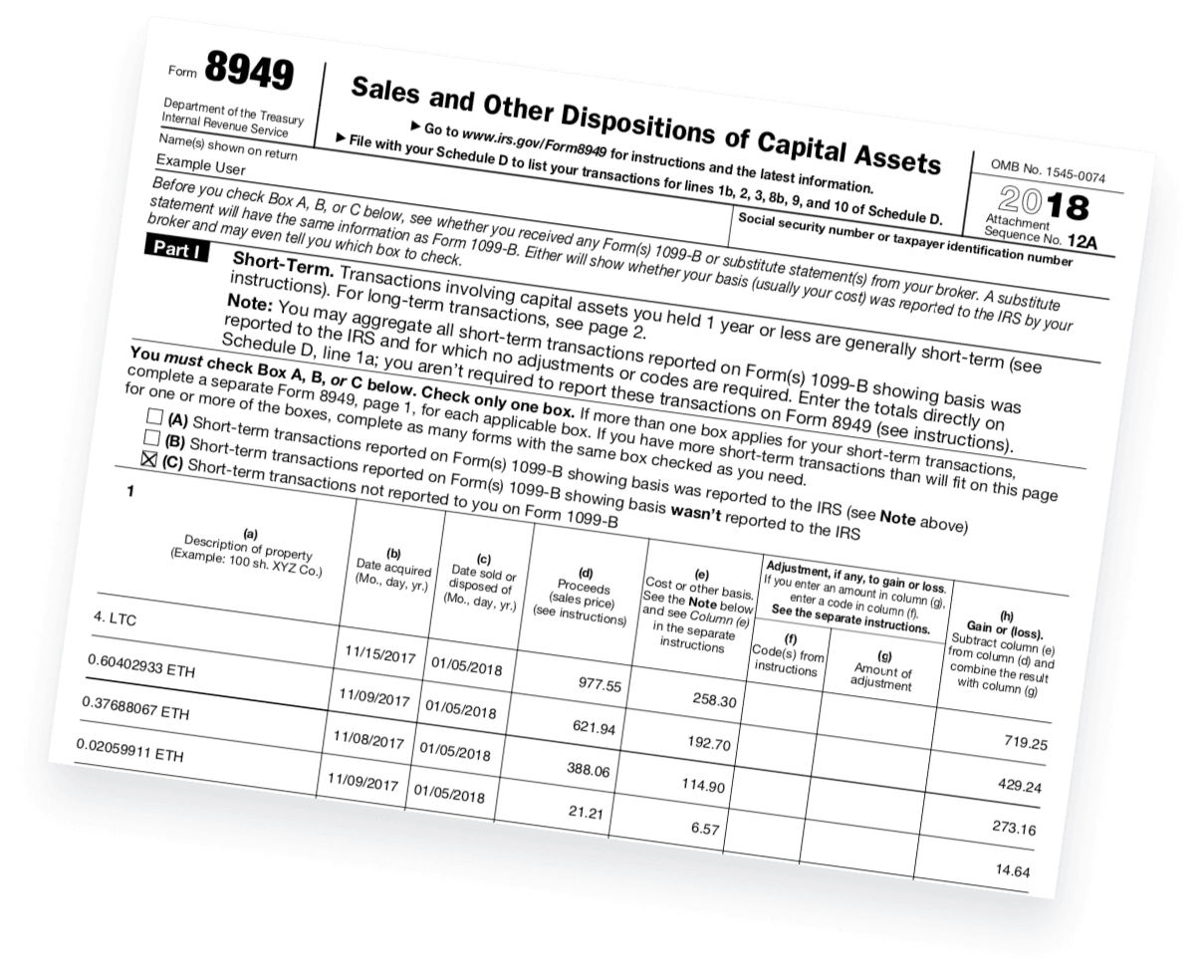

Our software automates the entire process of calculating crypto capital gains.

Simply connect your wallets and exchanges, and the system imports every transaction, applies HMRC’s tax rules, and generates a clear, compliant pre-filled report for your tax return.

You’ll always know exactly how much tax you owe, with the peace of mind that your calculations are correct. Try it for free!

Automatically imports transactions from all your platforms

Calculate accurately crypto gains/losses (Box 51 included)

Generates downloadable pre-filled reports in minutes

Ready-to-use tax reports, for you or your accountant

Get 30% off all plans

Start your free account and keep it forever. Upgrade any time for tax reports. Get a 30% discount with code UK30DISCOUNT until Dec 31.

Need more profiles for your family of crypto investors?

Mark L.

CryptoBooks made my 2023 tax filing seamless. The team really knows UK crypto regulation and helped me optimise gains and losses effectively. Support was quick, clear, and practical. Still my go-to in 2025.

Charles Z.

If you make frequent trades, this tool is indispensable. Tracks everything, calculates accurately and saved me hours of manual work.

Roy R.

By far the most complete crypto tax software I’ve used. It handled my income reporting flawlessly and updates are always aligned with the latest HMRC guidance.

Margaret M.

Exceptionally easy to use. CryptoBooks takes the stress out of tax season, especially with clear UK-compliant reports. Support team is responsive and helpful, whether on chat or email.

Cadence L.

Everything I needed to regularise my crypto taxes was right here, I was genuinely happy to find this platform. The interface is intuitive, and the educational content, especially the blog and videos, is a real bonus.

Robert C.

Consistently reliable. The platform evolves with the rules and translates complexity into practical solutions and the team clearly knows their stuff.