Spreadsheets were never meant for crypto

Spreadsheets weren’t built for crypto. Tracking trades across multiple wallets, exchanges, and DeFi platforms manually is not only time-consuming but also extremely risky.

Fees, timestamps, and token conversions are easy to miss, and one wrong formula can distort your entire tax report.

Even if you manage to keep it updated, you’re never completely sure if your data (or your taxes) are right.

CryptoBooks does it all for you

CryptoBooks was built for crypto, not adapted to it.

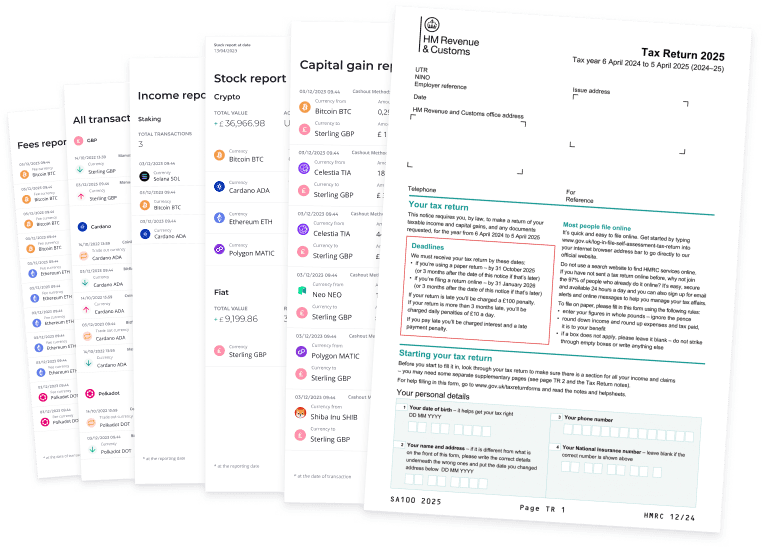

Simply connect your wallets and exchanges, and the platform automatically imports all your transactions, calculates your gains using HMRC-compliant rules, and generates your tax report in minutes.

No formulas. No manual work. Just clean, accurate data and a ready-to-file report you can trust.

Connect all your wallets and exchanges

Calculates gains according to HMRC rules

Eliminates manual errors and formulas

Generates ready-to-file tax reports

Get 30% off all plans

Start your free account and keep it forever. Upgrade any time for tax reports. Get a 30% discount with code UK30DISCOUNT until Dec 31.

Need more profiles for your family of crypto investors?

Mark L.

CryptoBooks made my 2023 tax filing seamless. The team really knows UK crypto regulation and helped me optimise gains and losses effectively. Support was quick, clear, and practical. Still my go-to in 2025.

Charles Z.

If you make frequent trades, this tool is indispensable. Tracks everything, calculates accurately and saved me hours of manual work.

Roy R.

By far the most complete crypto tax software I’ve used. It handled my income reporting flawlessly and updates are always aligned with the latest HMRC guidance.

Margaret M.

Exceptionally easy to use. CryptoBooks takes the stress out of tax season, especially with clear UK-compliant reports. Support team is responsive and helpful, whether on chat or email.

Cadence L.

Everything I needed to regularise my crypto taxes was right here, I was genuinely happy to find this platform. The interface is intuitive, and the educational content, especially the blog and videos, is a real bonus.

Robert C.

Consistently reliable. The platform evolves with the rules and translates complexity into practical solutions and the team clearly knows their stuff.