Ready in a few clicks

Our pre-filled reports give you what you need for your crypto tax return, covering SA100 and SA108. Download in a few clicks and get them straight to your inbox.

Fully compliant with UK tax law

CryptoBooks keeps you compliant with HMRC rules, applying share pooling to deliver accurate reports.

Complete documentation

Each report gives you all the details you need for your crypto tax return, explained in plain language and supported by a step-by-step guide.

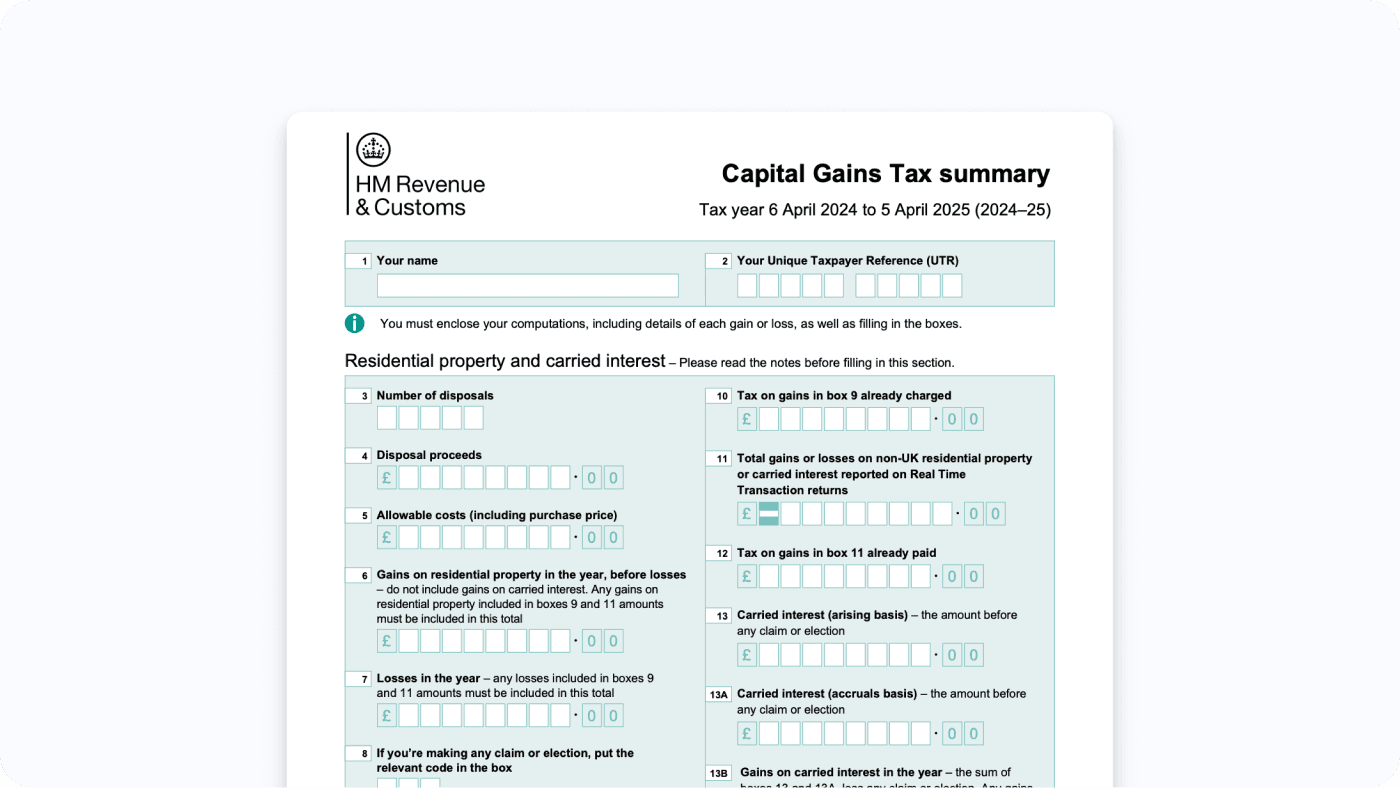

Pre-filled Self Assessment

Get your crypto tax return ready with pre-filled SA100 and SA108 forms, always aligned with HMRC rules.

Covers crypto gains and holdings

Always up to date with HMRC rules

Easy to share with your accountant

Accurate and ready for filing

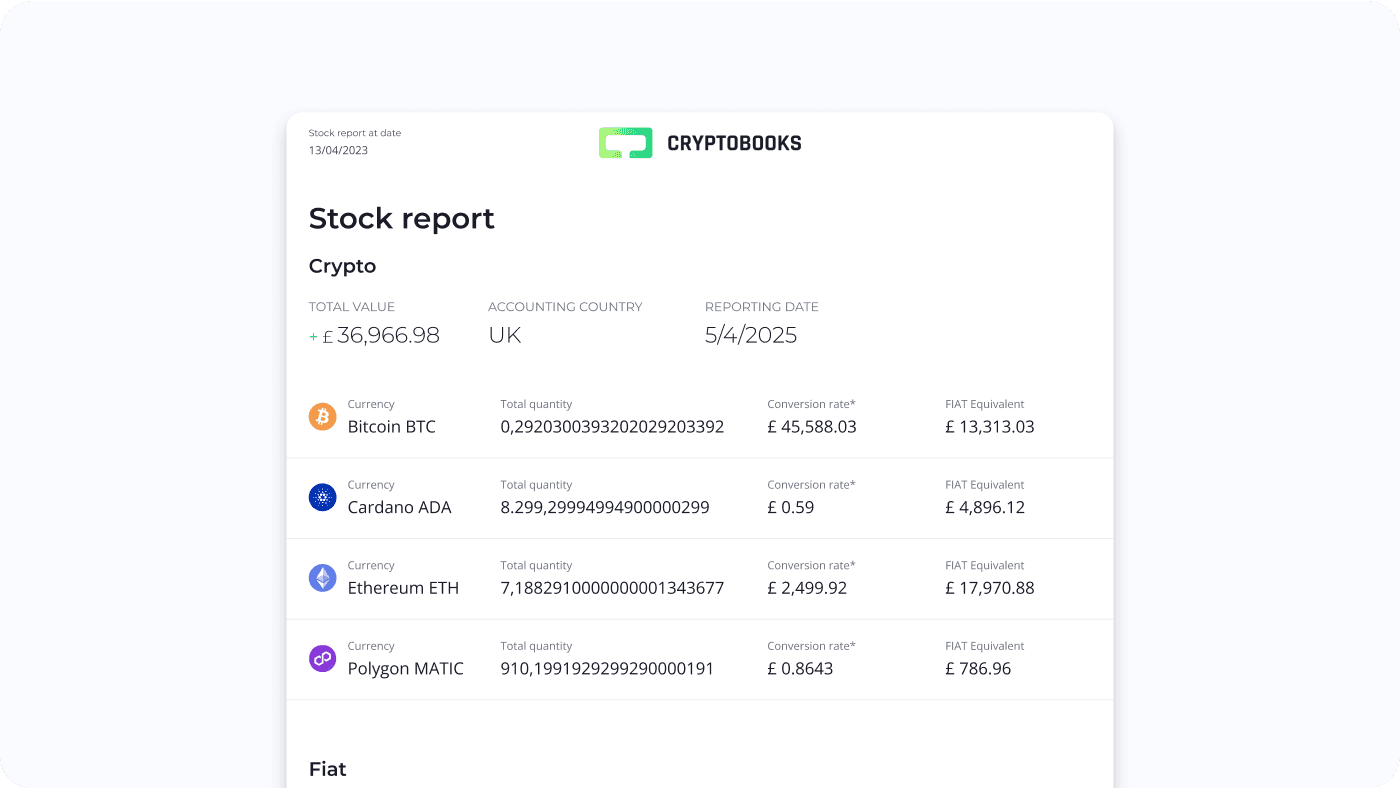

Stock report

This report indicates your cryptocurrency balance on the date you prefer, year by year. Essential for correctly filing your tax return.

Your total crypto holdings

Choose the year of your interest

Accurate data for your tax filing

Tax-return ready

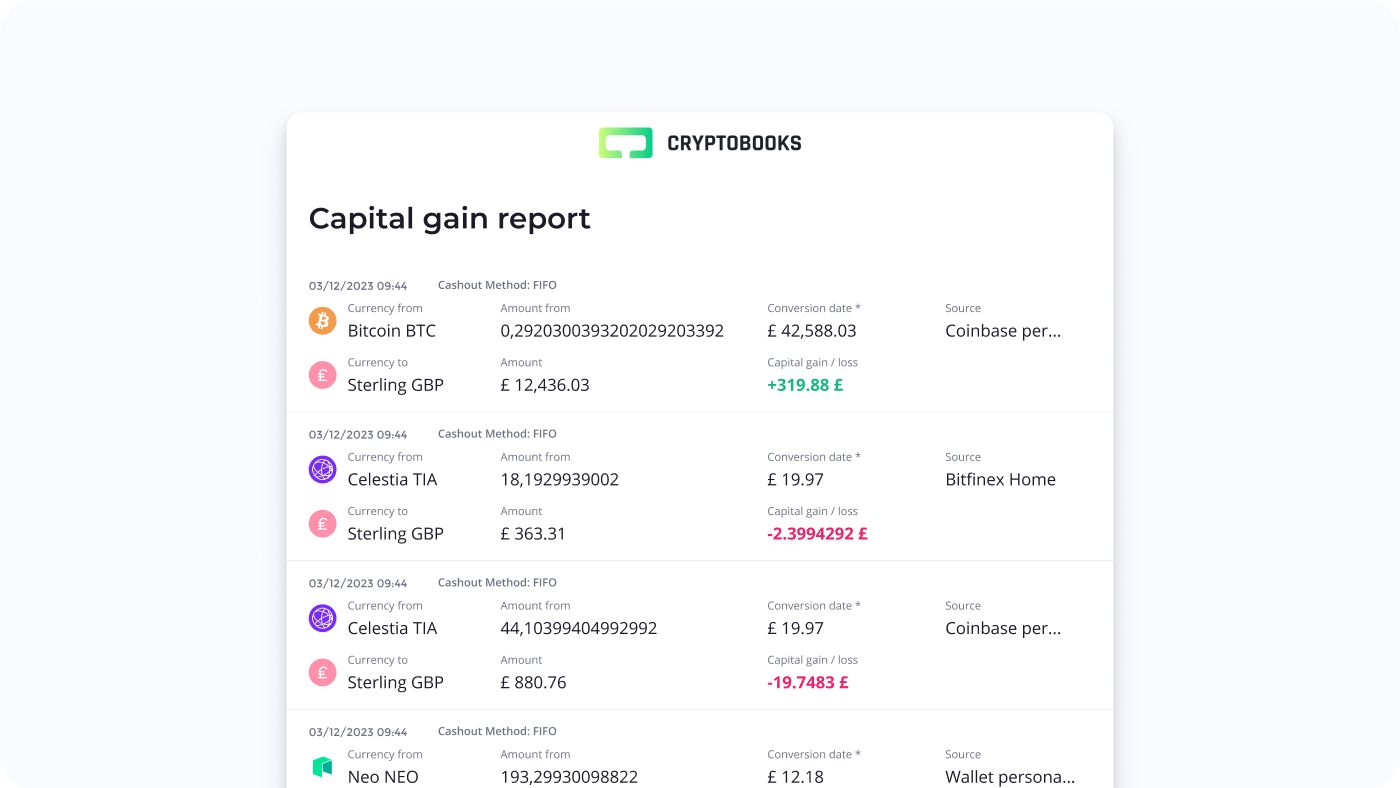

Capital Gain Report

The Capital Gain Report shows your realised gains and losses year by year, with all the data you need, calculated with full precision.

Data on your capital gains

Deductible losses

Year-by-year breakdown

Tax-ready data for your income declaration

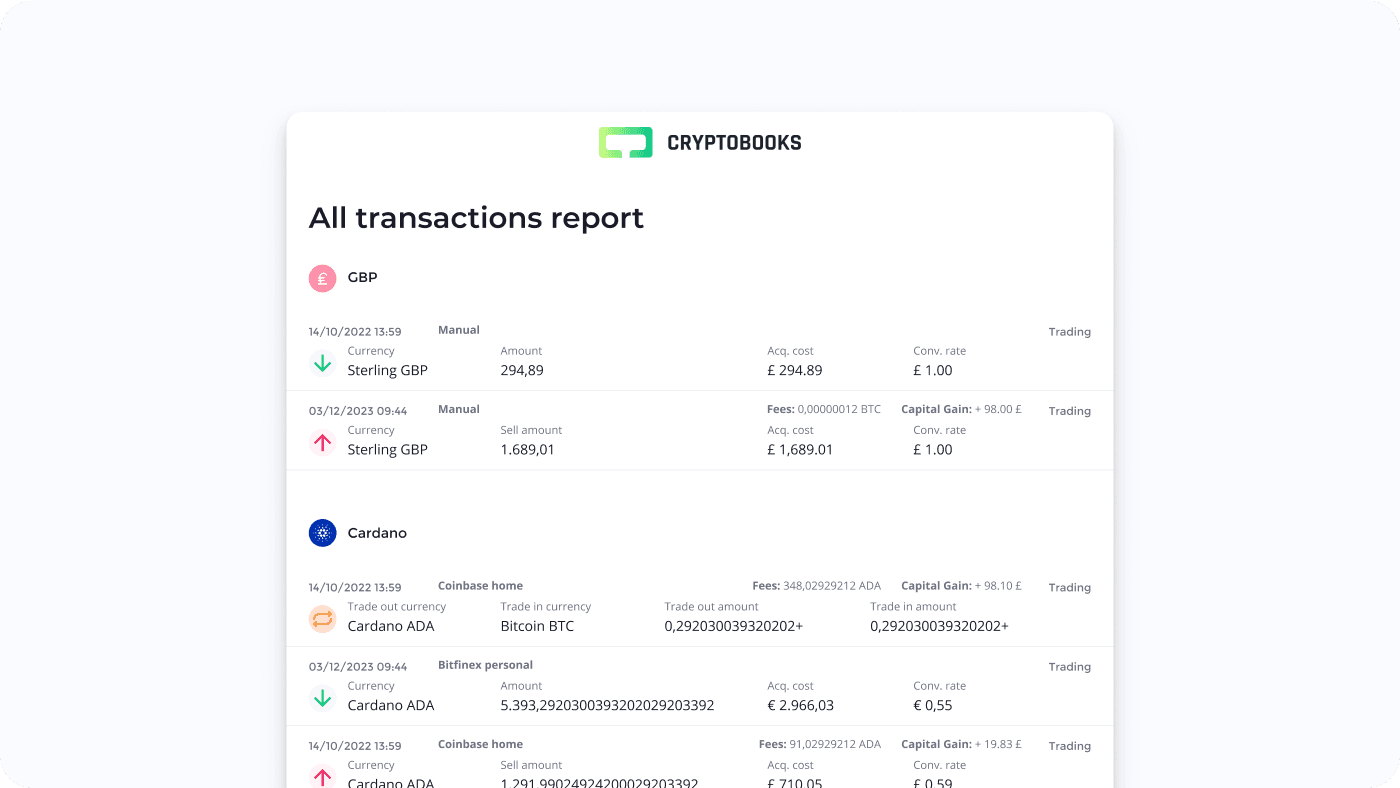

All Transactions Report

A complete record of all your transactions, fully reconciled and audit-proof, for any period you choose.

Your reconciled transactions

Filter by time period

Consistent and audit-ready

Ready for your accountant

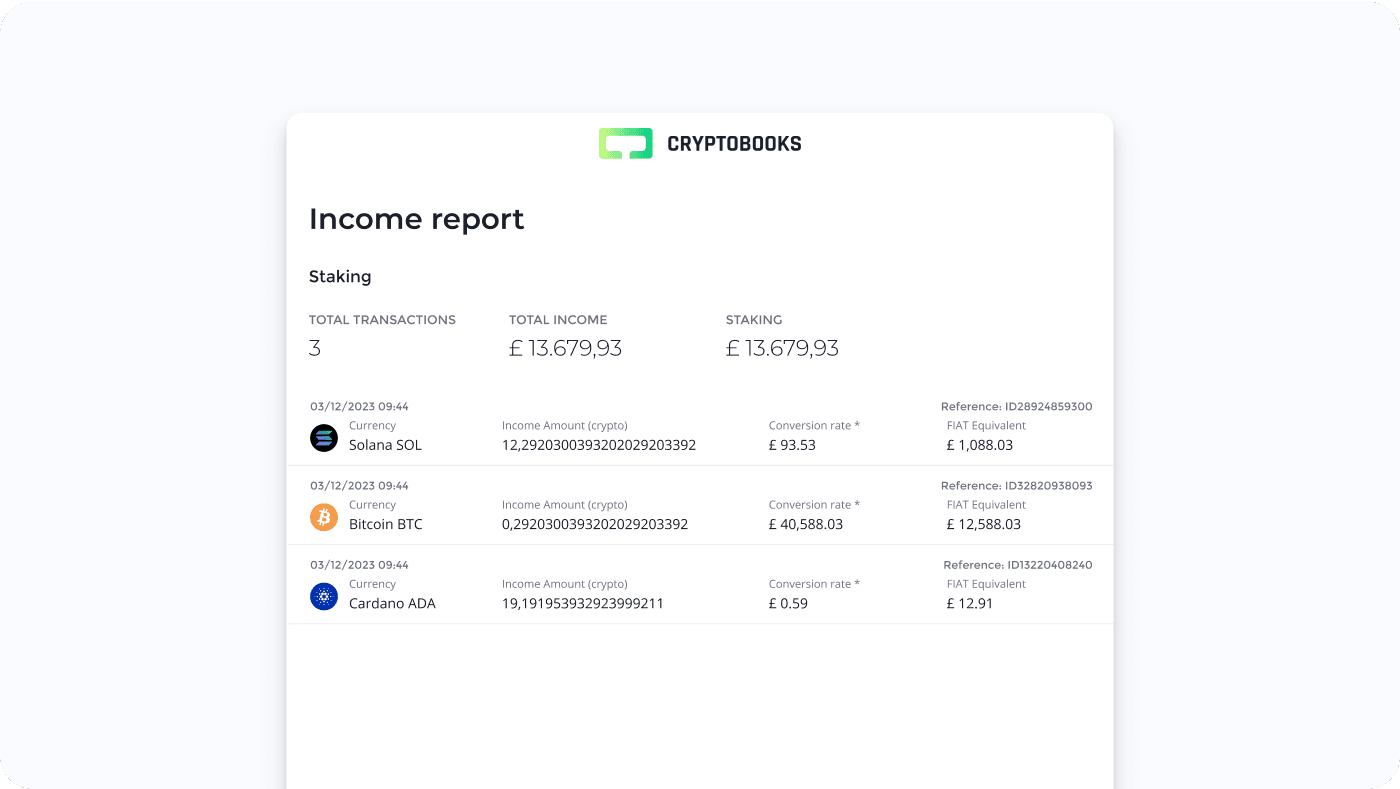

Income Report

This essential report lists all income received during your selected period, whether from staking or other crypto-related activity.

Staking income

Crypto earnings from network participation

Income paid in crypto

Guidance for income tax return

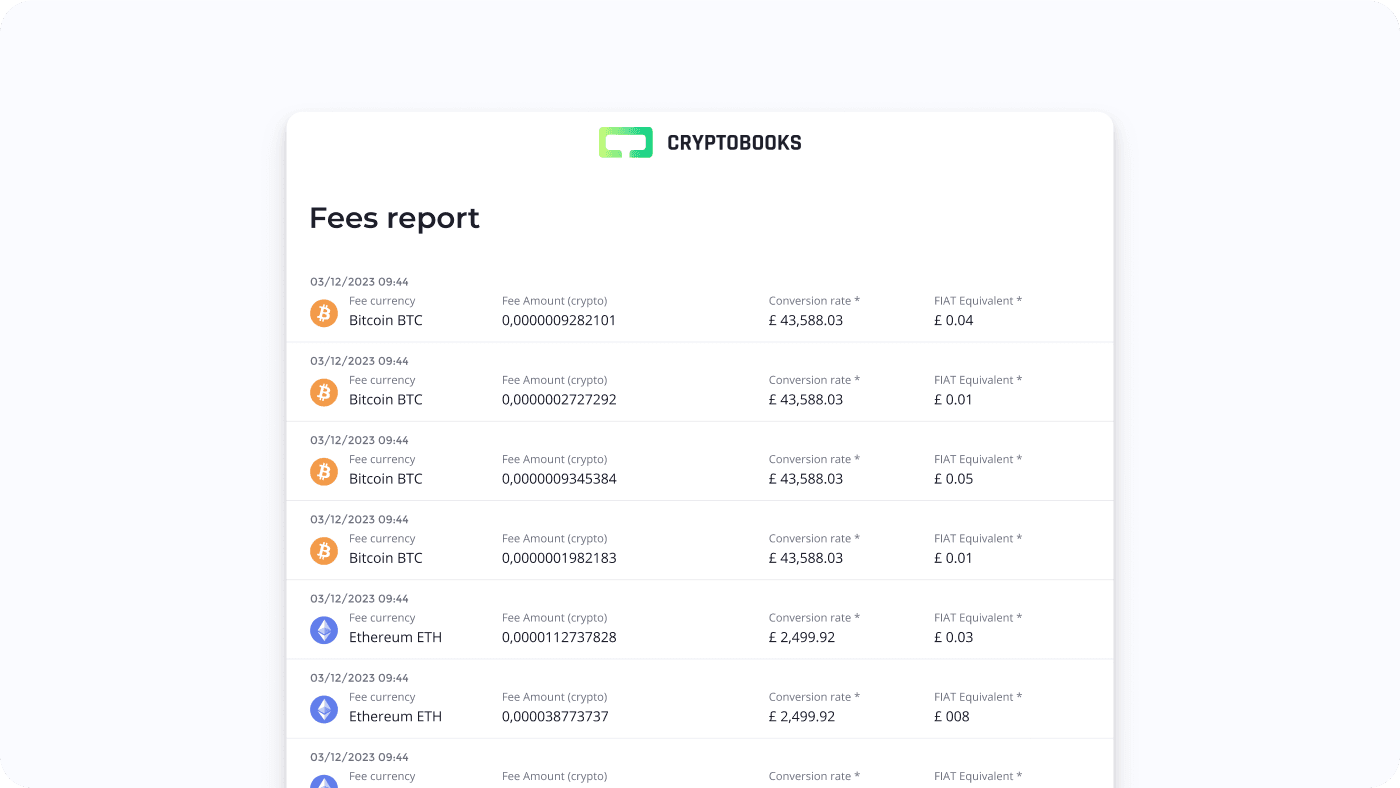

Fees Report

This document provides a summary of the costs and fees incurred during your crypto activities.

Exchange fees

Onchain fees

Operating costs

Maximum control over your activities

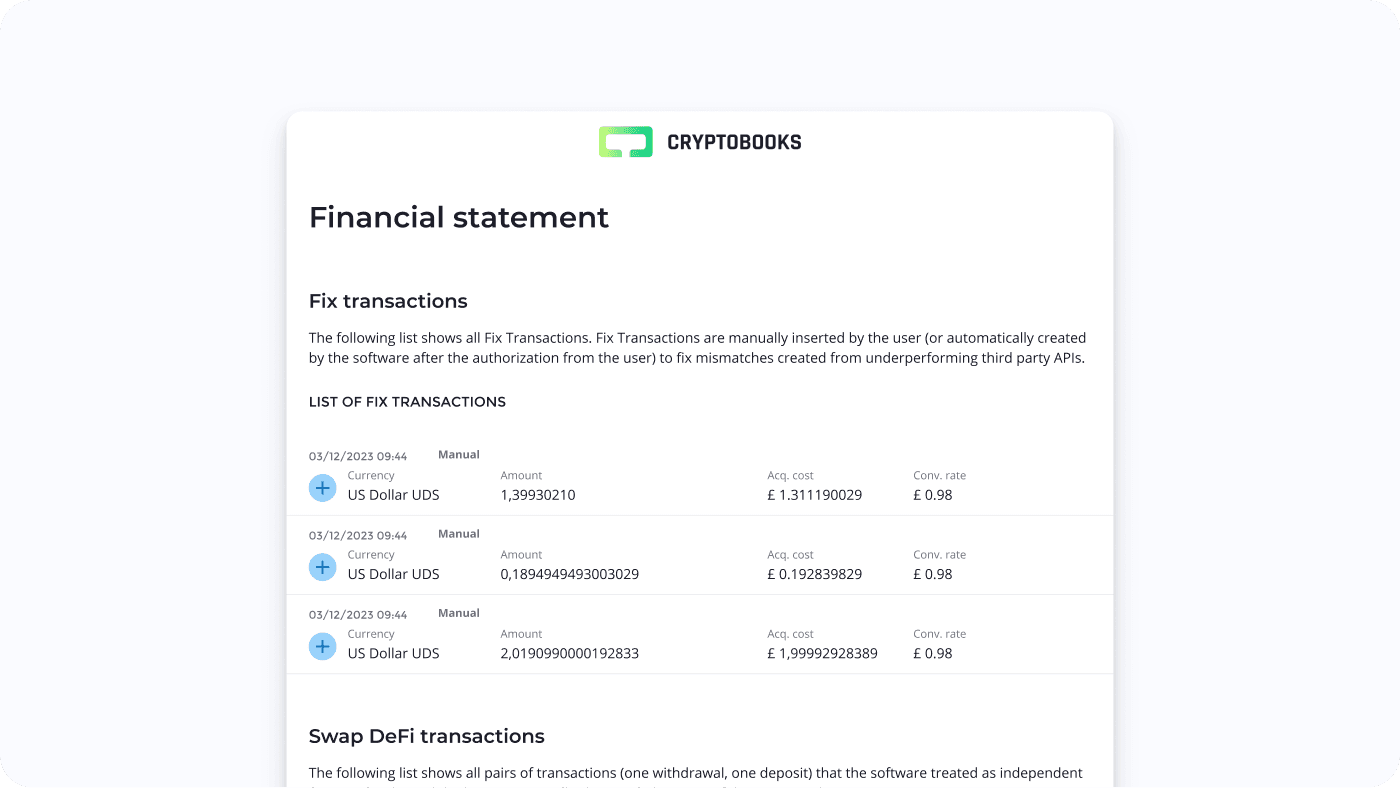

Financial Statement

The Financial Statement outlines the nature of the quantitative data and the calculation methods used, ensuring transparency and reliability in the event of a tax audit.

Overview of manual actions

Details of calculations performed

Transparency and reliability

Clear list of data sources

Mark L.

CryptoBooks made my 2023 tax filing seamless. The team really knows UK crypto regulation and helped me optimise gains and losses effectively. Support was quick, clear, and practical. Still my go-to in 2025.

Charles Z.

If you make frequent trades, this tool is indispensable. Tracks everything, calculates accurately and saved me hours of manual work.

Cadence L.

Everything I needed to regularise my crypto taxes was right here, I was genuinely happy to find this platform. The interface is intuitive, and the educational content, especially the blog and videos, is a real bonus.

Robert C.

Consistently reliable. The platform evolves with the rules and translates complexity into practical solutions and the team clearly knows their stuff.