A generic crypto tax software isn’t enough for the UK

Most crypto tax software is built to “work everywhere”, which often means it works properly nowhere.

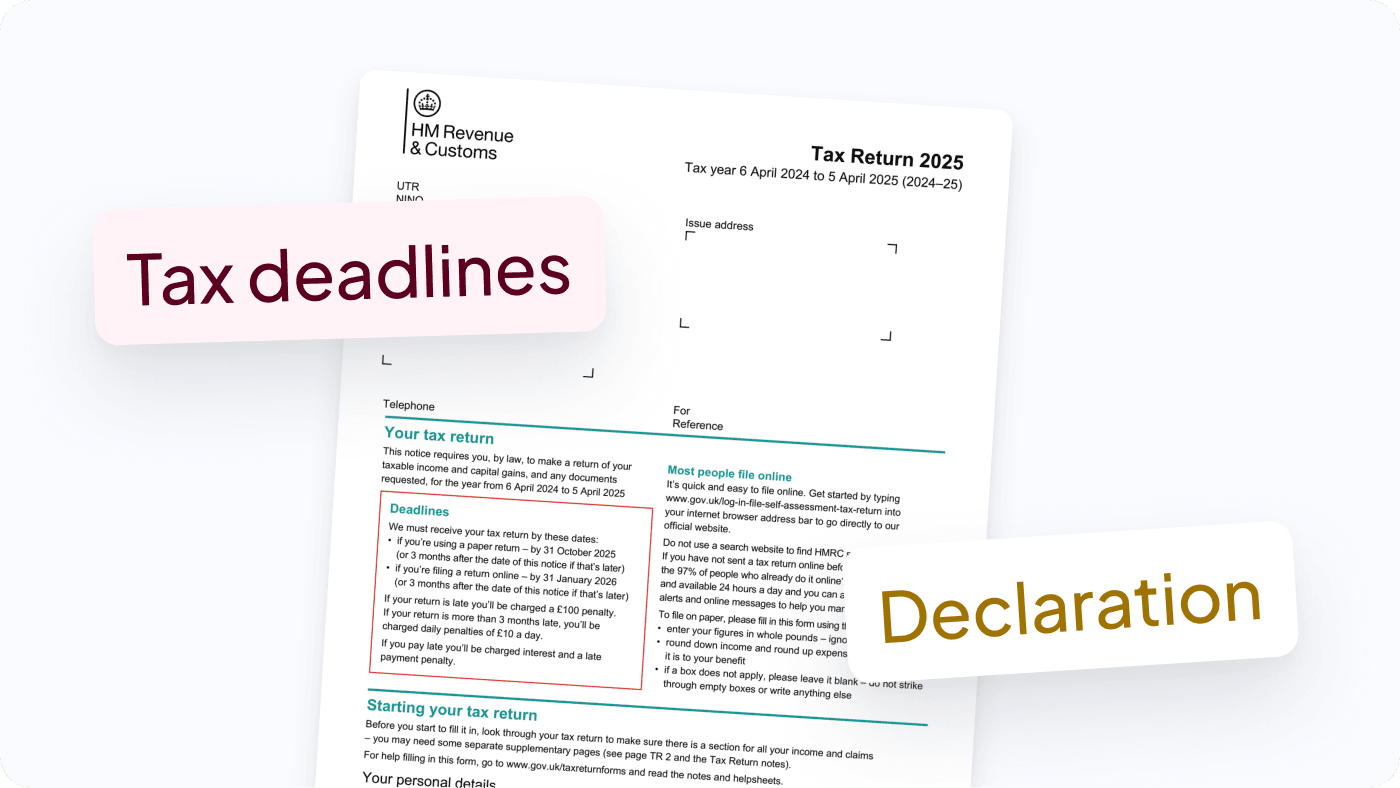

Generic tools may calculate gains, but they frequently fail to apply UK-specific rules such as same-day matching, the 30-day rule, income classification, or recent CGT rate changes.

For UK taxpayers, using a software that isn’t fully aligned with HMRC guidance can lead to incorrect calculations, underpaid tax, or unnecessary amendments later on.

CryptoBooks: the crypto tax software designed for HMRC compliance

CryptoBooks is not just a generic crypto calculator. It’s crypto tax software built specifically for the UK, continuously updated to reflect the latest HMRC guidance and regulatory changes.

The platform applies UK-specific rules automatically, separates transactions by tax treatment, and generates reports that align with Self Assessment requirements. Instead of adapting a generic tool to UK rules, CryptoBooks does it for you accurately, transparently, and with full confidence that your calculations are HMRC-compliant.

Start now for free.

Connect your wallets and exchanges

Automatically corrects errors with the AI

Download the most accurate and legally compliant reports

Ready-to-use tax reports, for you or your accountant

Get 30% off all plans

Start your free account and keep it forever. Upgrade any time for tax reports. Get a 30% discount with code UK30DISCOUNT until Dec 31.

Need more profiles for your family of crypto investors?

Mark L.

CryptoBooks made my 2023 tax filing seamless. The team really knows UK crypto regulation and helped me optimise gains and losses effectively. Support was quick, clear, and practical. Still my go-to in 2025.

Charles Z.

If you make frequent trades, this tool is indispensable. Tracks everything, calculates accurately and saved me hours of manual work.

Roy R.

By far the most complete crypto tax software I’ve used. It handled my income reporting flawlessly and updates are always aligned with the latest HMRC guidance.

Margaret M.

Exceptionally easy to use. CryptoBooks takes the stress out of tax season, especially with clear UK-compliant reports. Support team is responsive and helpful, whether on chat or email.

Cadence L.

Everything I needed to regularise my crypto taxes was right here, I was genuinely happy to find this platform. The interface is intuitive, and the educational content, especially the blog and videos, is a real bonus.

Robert C.

Consistently reliable. The platform evolves with the rules and translates complexity into practical solutions and the team clearly knows their stuff.