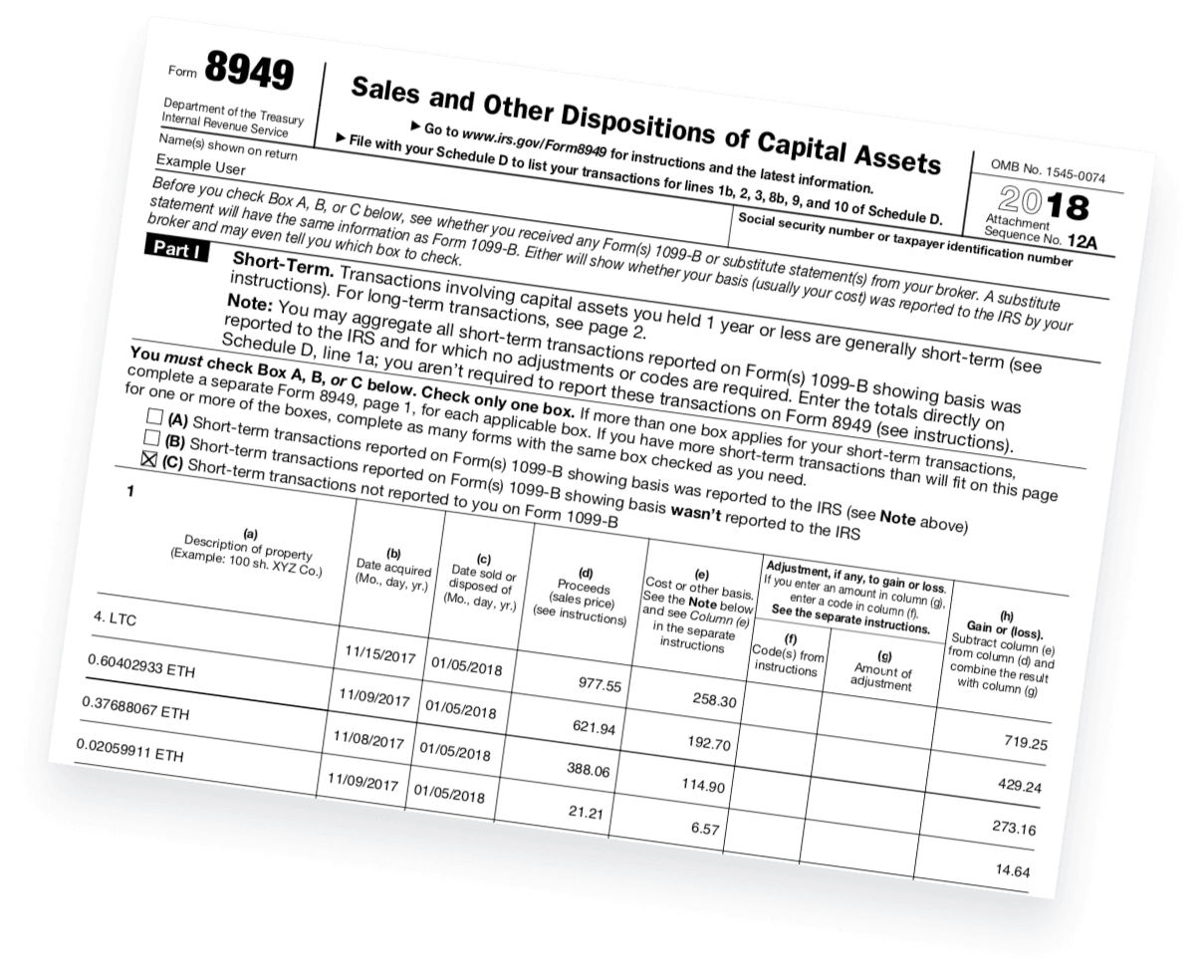

It is extremely difficult to properly account for your cryptocurrencies

We know that crypto taxation is a headache.

Accurately accounting for each transaction, finding missing data, resolving discrepancies... even with the help of software like CryptoBooks, is neither quick nor easy.

The situation is even worse when it comes to a large number of assets and a large number of transactions. In these cases, the risk of making mistakes in your declaration is even more real.

Crypto taxation is a nightmare

Reporting cryptocurrencies correctly is a titanic quest

The situation is more complicated in the case of large assets

The risk of mistakes in your declaration is extremely high

Even small mistakes can have huge consequences

Picture this: you make a small oversight on your crypto tax return—maybe you miscalculate your gains, omit a critical transaction, or fail to properly document your holdings. In the eyes of HMRC, these aren’t minor errors; they’re red flags that could trigger hefty fines, backdated tax bills, or even investigations.

With the tax return deadline approaching, pressure builds. Rushing to compile data, ensure accuracy, and meet the submission date adds to the risk of slip-ups. The complexity of crypto assets only increases the challenge.

One small misstep before the tax deadline could cost you far more than a sleepless night.

Small errors in your crypto tax return can lead to severe fines or investigations from HMRC

Rushed, last-minute filing increases the risk of costly mistakes

The tax deadline approaching adds pressure to get every calculation and declaration right

Misreporting or overlooking transactions can jeopardize your financial stability

Let our experts handle your crypto taxation

Why face the complex challenge of crypto taxes alone and risk costly errors? Our professional team will manage every aspect of your crypto accounting, ensuring your tax return is filed accurately and on time.

With us, you can enjoy total peace of mind: no mistakes, no stress, just expert handling of your crypto finances.

Get your tax return sorted seamlessly. Book your free quote today—but act fast, as our availability is limited!

And that's not all: you get a special 30% discount on our Crypto Accounting Service if you book before 31.12: act now!

Avoid the risk of costly errors

We manage everything for you

We'll ensure you 100% compliance to the UK laws

If you book before 31.12 you can get a 30% discount

Mark L.

CryptoBooks made my 2023 tax filing seamless. The team really knows UK crypto regulation and helped me optimise gains and losses effectively. Support was quick, clear, and practical. Still my go-to in 2025.

Charles Z.

If you make frequent trades, this tool is indispensable. Tracks everything, calculates accurately and saved me hours of manual work.

Roy R.

By far the most complete crypto tax software I’ve used. It handled my income reporting flawlessly and updates are always aligned with the latest HMRC guidance.

Margaret M.

Exceptionally easy to use. CryptoBooks takes the stress out of tax season, especially with clear UK-compliant reports. Support team is responsive and helpful, whether on chat or email.

Cadence L.

Everything I needed to regularise my crypto taxes was right here, I was genuinely happy to find this platform. The interface is intuitive, and the educational content, especially the blog and videos, is a real bonus.

Robert C.

Consistently reliable. The platform evolves with the rules and translates complexity into practical solutions and the team clearly knows their stuff.