We specialize in cryptocurrency bookkeeping

CryptoBooks calculates taxes on your cryptocurrencies with 100% accuracy: the peace of mind of correct tax reports, ready to be delivered directly to your accountant.

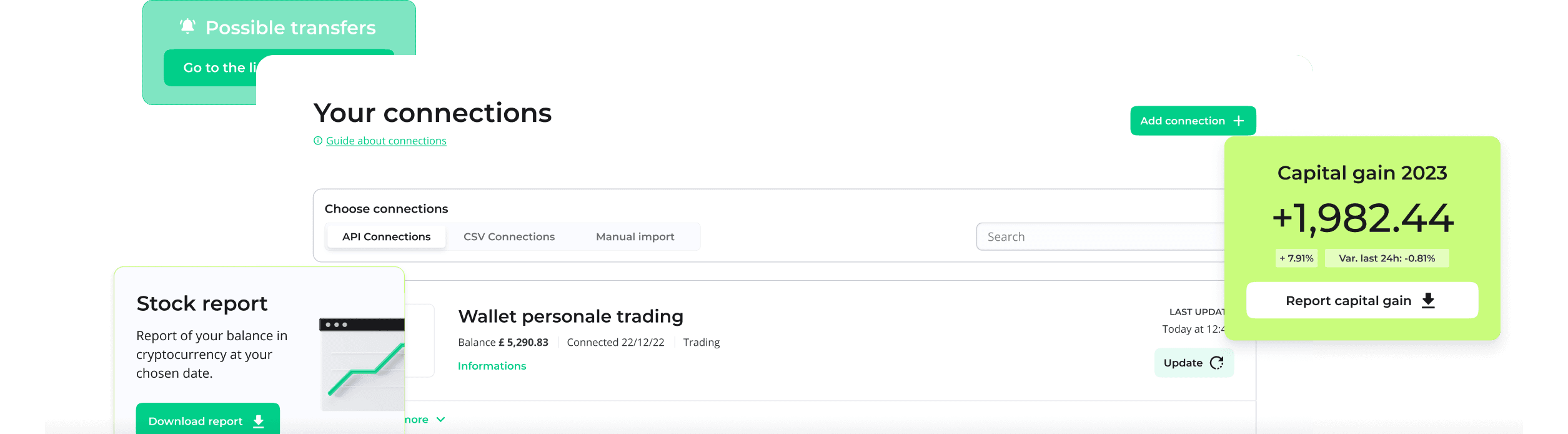

Connect and reconcile all your platforms and wallets

You can connect all your platforms and wallets to CryptoBooks: the already integrated connections exceed 500, both through APIs and CSV. And if you don't find what you're looking for, you can create custom connections.

Monitor and verify your cryptocurrency transactions

Utilize guided procedures or our Artificial Intelligence for assistance: resolve discrepancies easily and swiftly.

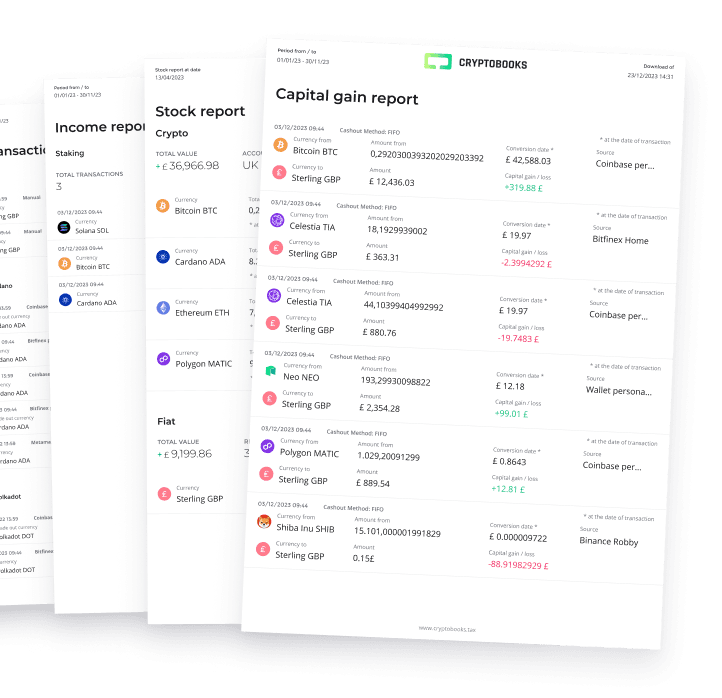

Download your cryptocurrency tax reports

Export your cryptocurrency tax reports to provide to your accountant or use directly for your Income Tax Return. They are the most accurate reports you can obtain and are 100% compliant with the latest UK tax laws.

Over 500 connections for you

Easily connect your exchanges, wallets, and blockchain addresses with CryptoBooks! We support all exchanges without exceptions.

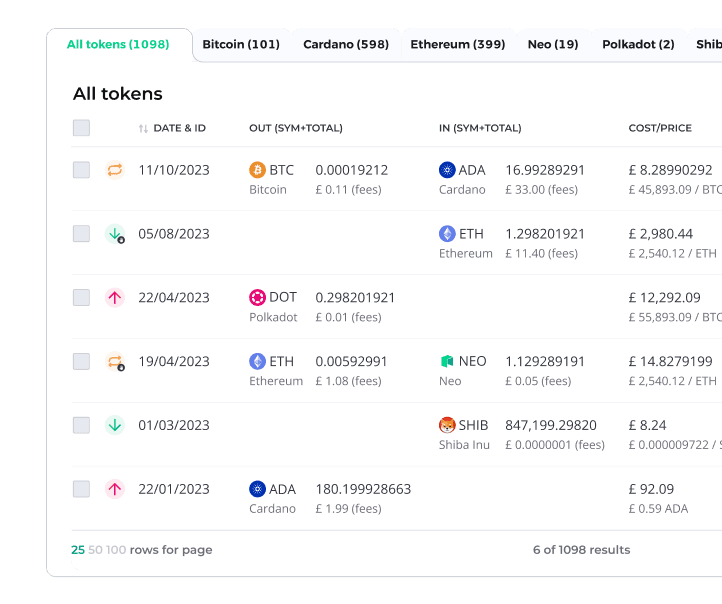

Import and verify your transactions

Automatically import transactions from your exchanges via API or CSV files, and connect your wallets using public addresses. CryptoBooks automatically identifies errors, providing helpful suggestions for resolution.

Sync data via API

Sync data on the blockchain

CSV file import

Error checking

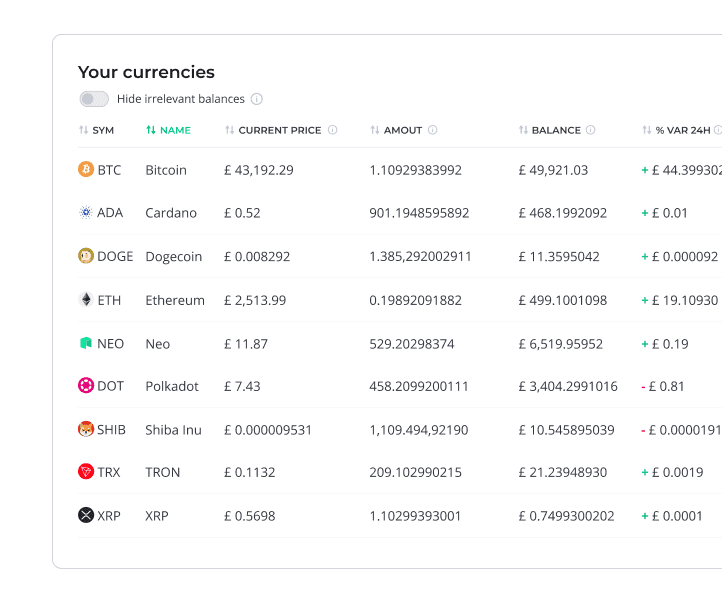

Discover precisely how much taxes you should pay

Examine in detail all tax-relevant movements on your cryptocurrency transactions and get a real-time preview of your tax statement.

Transfers reconciliation check

Management of SPAM tokens

Balance misalignments

Resolution center

Download your tax reports

Get all the calculations and reports you need to complete your cryptocurrency tax return. Download tax reports with just one click!

Crypto portfolio value

Capital gains/losses

Staking income

And much more

We are always by your side

Step-by-step guided processes

At any time, follow our step-by-step guided processes for every task. If that's not enough, we have guides and documentation to explain each function step by step. You have our 100% support, also available via chat.

Automations and AI

If you don't want to spend too much time on corrections and potential gaps from exchanges that don't provide all the data, use our automatic AI-based system. We track all errors and provide suggestions to resolve them.

Seek help from us

For a "turnkey" management that also solves the most specific cases, you can seek help from one of our expert consultants who will work on your behalf to provide you with perfect crypto accounting.

Felix S.

I'm giving myself the opportunity to approach a technical world where I'm taking my first steps.

Jasper T.

Great product, essential especially for those who carry out a lot of transactions.

Aurelia Q.

An easy-to-use software to have all your portfolio in one place, capable of creating comprehensive and accurate reports for UK taxation.

Seraphina G.

One of the easiest-to-use programs for cryptocurrency reporting, and additionally compliant with UK regulations. Fast and friendly assistance is available both through online chat and email.

Imogen B.

I am happy to have used your platform to generate what is necessary for the tax regularization of my crypto. I find the platform convenient, and I appreciate the informative content you create, including articles and especially videos.

Casper W.

Reliable platform and team, serious and competent. Always one step ahead of industry updates and with great ability to translate and apply knowledge into the software and service offered.

Got questions? We have answers

What does CryptoBooks do exactly?

CryptoBooks is a software or web app that allows you to connect your crypto platforms (such as your crypto exchanges), your wallets and blockchains you have used. The aim is to reconstruct the history of your transactions from the first one you made to the most recent. With this reconstructed history, CryptoBooks can calculate and show you the total value of cryptocurrencies you have owned year by year, along with the corresponding value in euros and then it calculates the capital gains or losses you have incurred on an annual basis. This steps lead to the final one: it informs you about the amount of taxes on your crypto activities you are expected to pay.

How does the free trial work?

It's very simple: you register for free without the use of a credit card, which is never required. You can use Cryptobooks without limitations for one week: you can connect wallets and exchanges, import transactions, edit categories, manage transfers, and do everything a paying user can do. To download tax reports, you will be asked to choose a subscription. If you don't like it, you let it expire.

How does CryptoBooks help me with my tax return, and do it without errors?

As you may know, in UK, it is necessary to declare any capital gains and losses in your Tax Declaration. A specific substitute tax is applied to the gains but its amount can vary. CryptoBooks covers numerous use cases for cryptocurrencies. Have you staked and are unsure how to report the gains? Don't worry: CryptoBooks understands how things work in UK and handles specific use cases like staking, as well as mining, liquidity pooling, farming, networking, etc., seamlessly. You just need to connect your platforms! Once the platforms are connected, you download CryptoBooks reports, which are so well-crafted that they precisely show you which data to enter in the various Tax Return sections.

Is the software updated to recent cryptocurrency laws?

CryptoBooks is a project managed by a highly competent team in the field of crypto taxation, with the main purpose of assisting UK taxpayers. It is regularly updated to the latest regulatory developments. We can confidently state that there are no other software solutions as up-to-date and compliant with UK law as CryptoBooks. For this reason, if you are a UK resident, the best choice you can make is to rely on us. We ensure complete compliance with the laws and the most accurate results possible!

Does CryptoBooks replace my accountant?

CryptoBooks allows you to track and account for all your cryptocurrency transactions for tax purposes, reconciling them all together and providing you with the correct figures to include in your tax return. The accountant is the person you rely on to take these numbers and input them correctly into the declaration or use them to define the best filing strategy for you. CryptoBooks and your accountant, therefore, perform two different roles. You can think of CryptoBooks as your cryptocurrency bookkeeper!

Why should I choose to try CryptoBooks for free instead of another software? What does it offer more than others?

CryptoBooks is the first software of its kind that aims not only to provide you with reports in a very short time – which is expected – but to give you the most accurate reports, even if it means waiting a few extra minutes. CryptoBooks alerts you to any errors it finds in the data sources you connect, allowing you to fix them either automatically – thanks to the internal AI – or manually. The reports are 100% accurate, and CryptoBooks is the most up-to-date software on the market in compliance with UK regulations. Other software, while certainly valid, may not be updated to the latest laws, so you would not be as protected as you would be with CryptoBooks.

I know nothing about crypto taxation and reporting; is CryptoBooks suitable for me?

CryptoBooks is an app designed for anyone who has cryptocurrencies, even for those who know nothing about taxes, finance, and cryptocurrency tax reporting. The ease of use, immediacy, and the ability to consult numerous step-by-step guides, along with the always active live chat support with a real operator, contribute to CryptoBooks being rated 5 out of 5 stars by our users for "Ease of Use!" Try it to believe it!