The tax laws regarding crypto staking are clear: 100% accuracy is needed

The challenging part is correctly accounting for your cryptocurrencies, especially if you have staked them

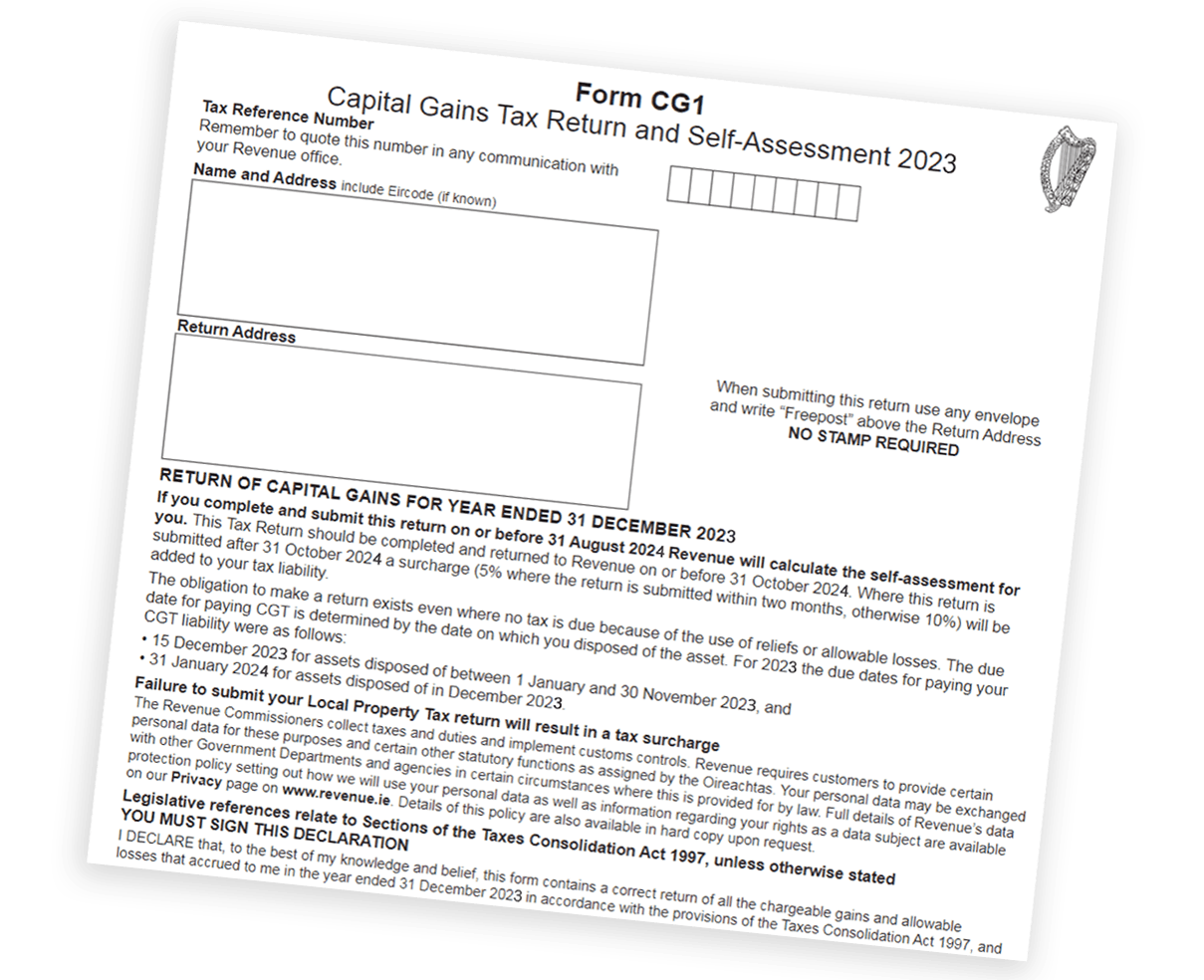

As a cryptocurrency investor, strict adherence to irish tax laws is crucial. It is mandatory to complete your crypto tax return, declaring all gains (so called "rewards") resulting from cryptocurrency staking.

There is a growing trend in rigorous audits and notifications by tax authorities (Revenue), specifically targeting individuals who neglect to report their cryptocurrency gains, also on activities like staking.

Navigating cryptocurrency tax complexities is challenging, but accurate reporting is crucial. With CryptoBooks, we streamline the process, providing 100% accurate reporting to ensure efficient compliance with your crypto tax return and prevent any surprises. Reporting your cryptocurrencies has never been more accessible and reliable.

You must comply with tax regulations, or risk hefty penalties

Correctly reporting your crypto is a herculean task

You need a software perfectly calibrated to the laws of Ireland

You have to declare your crypto staking income by October 31st

Need to calculate your crypto staking income and related taxes?

It's actually complicated: income from staking is calculated differently than normal capital gains. As a matter of fact, staking is considered a proper income and thus is subject to income taxation.

Moreover, when you sell your crypto staking rewards you have to calculate the related value differently than the same crypto used as main capital and put under stake. The accounting system to do so is called FIFO (First In First Out).

How to manage this complexity? Considering that most likely you also have to calculate taxes on different crypto and capital gains or losses? How to know exactly how much tax you have to pay to be compliant with the evermore strict rules of Ireland and Europe on crypto tax?

Not being compliant will lead to fines

The deadline is on 31st October

Staking rewards are considered a proper "income"

The hard part is bookkeeping your crypto (FIFO method)

CryptoBooks is the solution you're looking for

CryptoBooks is the software perfectly aligned with the latest irish regulations, applying correct calculation methods and allowing you to address any discrepancies, ensuring peace of mind with the tax authorities.

Through a comprehensive set of reports, you will be able to input the most accurate figures in your tax return, avoiding the risk of overpayment or potential tax penalties.

You can try CryptoBooks for free for 7 days!

Connect your wallets and exchanges

Automatically detect errors

Download the most accurate and legally compliant reports

Ready-to-use tax reports for staking and all crypto-related use cases

And after the free trial? You can purchase CryptoBooks with this incredibile offer: 40% discount on every plan

After the 7-day free trial, you can choose the plan that best suits your needs.

Felix S.

I'm giving myself the opportunity to approach a technical world where I'm taking my first steps.

Jasper T.

Great product, essential especially for those who carry out a lot of transactions.

Aurelia Q.

An easy-to-use software to have all your portfolio in one place, capable of creating comprehensive and accurate reports for irish taxation.

Seraphina G.

One of the easiest-to-use programs for cryptocurrency reporting, and additionally compliant with Ireland's regulations. Fast and friendly assistance is available both through online chat and email.

Imogen B.

I am happy to have used your platform to generate what is necessary for the tax regularization of my crypto. I find the platform convenient, and I appreciate the informative content you create, including articles and especially videos.

Casper W.

Reliable platform and team, serious and competent. Always one step ahead of industry updates and with great ability to translate and apply knowledge into the software and service offered.

Got questions? We have answers

Can I try CryptoBooks before paying?

Yes! You can use CryptoBooks for 7 days completely free to import the entire history of your cryptocurrency transactions, view your gains and net capital losses, and monitor your portfolio. Payment is only required when you want to download and view your complete tax reports. Some features may also be restricted during the free trial.

What sets apart CryptoBooks plans?

The main difference is the number of transactions the software can account for, varying from plan to plan. Additionally, specific features are unlocked only in the more advanced plans, such as the multi-profile for 5 users, which is available exclusively with the Trader Plus plan.

And if I reach the transaction limit set by my plan?

No worries, no problem: you can upgrade whenever you want, paying the difference between the new and current plans. Additionally, we'll prorate the time already elapsed so you can save even more!

If I have a discount code, where can I enter it?

If you have a discount code for CryptoBooks, you can easily enter it during the payment phase: there's a dedicated field clearly highlighted on the page. Don't forget to click "Apply" to apply the discount! The price shown in the cart will reflect the applied discount. By completing the payment, you've correctly used the discount code.

What is the refund policy?

If CryptoBooks doesn't meet your needs, you have 14 days to request a refund from customer support. We kindly ask you to provide feedback and let us know what you didn't like about the service; it would greatly help us improve our product!

If I'm part of a Community with a dedicated feature, which plan should I choose?

CryptoBooks has partnerships with many communities. If you belong to one, you should have received instructions to activate the dedicated features. Generally, the process involves activating a specific code during the license activation, unlocking the feature associated with the community. For further assistance, contact customer.support@cryptobooks.tax!

Are my payment details secure?

Absolutely! CryptoBooks does not store your payment data on its servers. Your payment data is stored by Stripe, the payment system we rely on. Stripe is a global leader in online payments and adopts the most secure procedures to ensure that your data is in excellent hands.