Ready in a few clicks

Our pre-filled reports give you what you need for your crypto tax return. Download the pre-filled tax return form in a few clicks and get them straight to your inbox.

Fully compliant with Irish tax law

CryptoBooks keeps you compliant with Irish tax law, applying FIFO method rules to deliver accurate reports.

Ready for your tax return

Each report gives you all the details you need for your crypto tax return, explained in plain language and supported by a step-by-step guide.

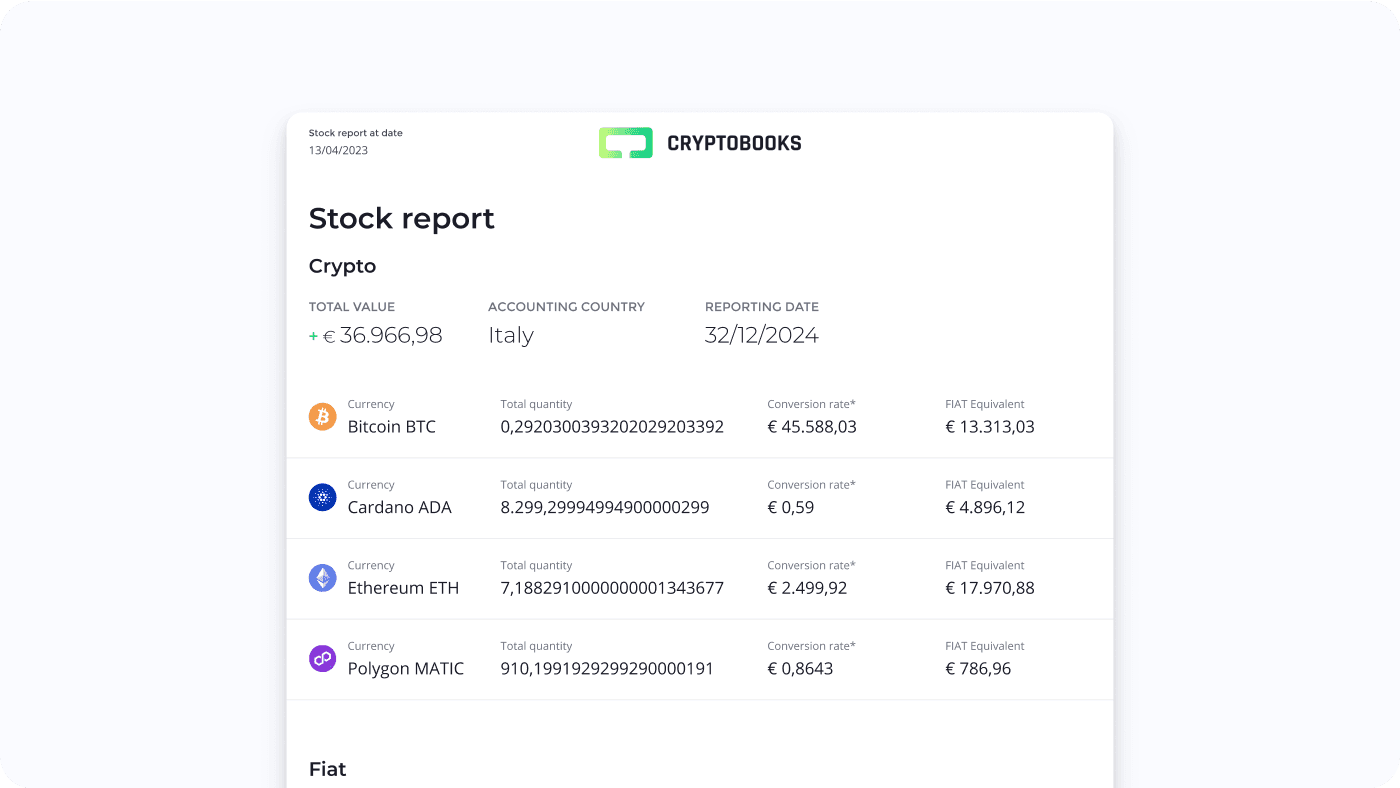

Stock report

This report indicates your cryptocurrency balance on the date you prefer, year by year. Essential for correctly filing your tax return.

The amount of your crypto

Choose the year of your interest

Accurate data for your tax filing

Ready to use

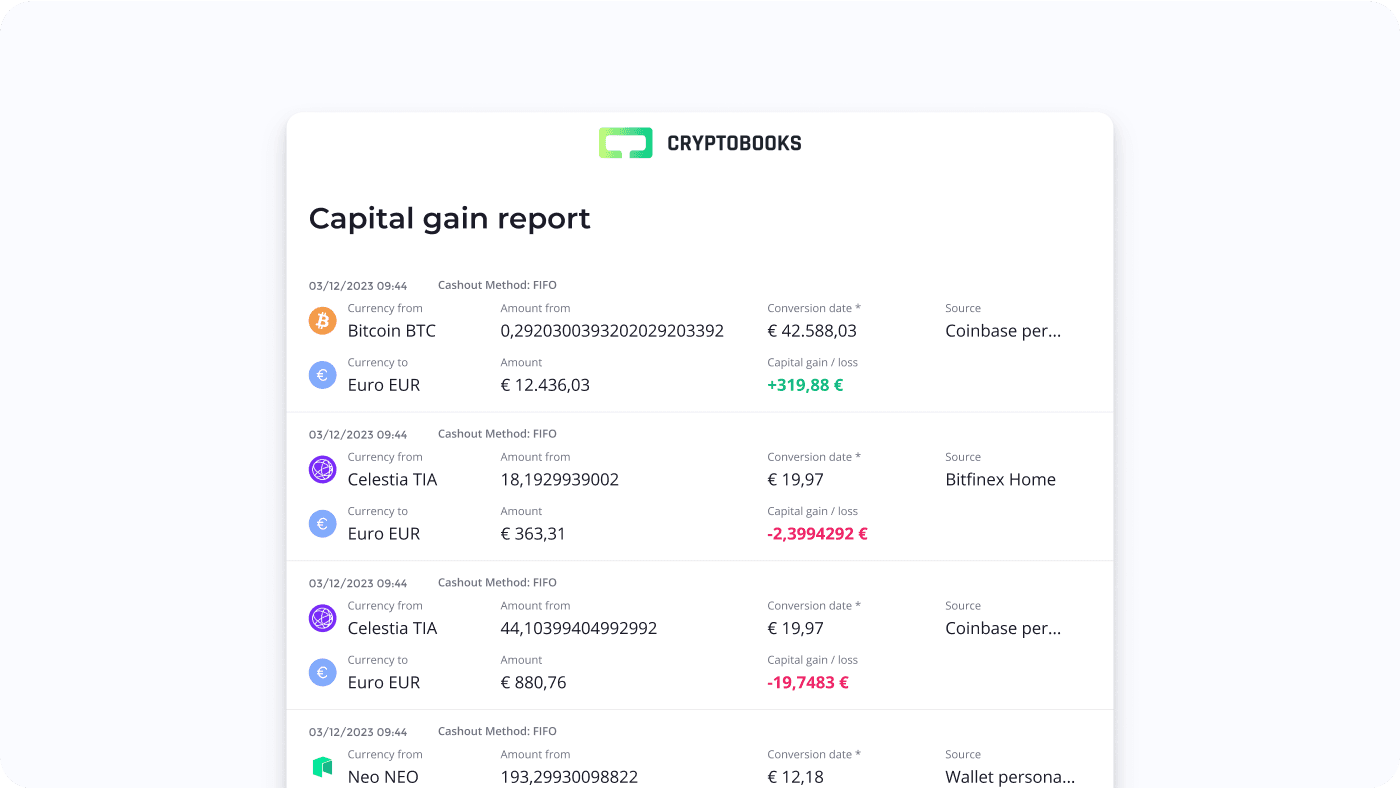

Capital gain report

The Capital Gain report shows you the capital gains and losses realized year by year: you will have all the data you need, accurate to the millimeter.

Data on your capital gains

Deductible losses

Year-by-year breakdown

Data for your income tax return

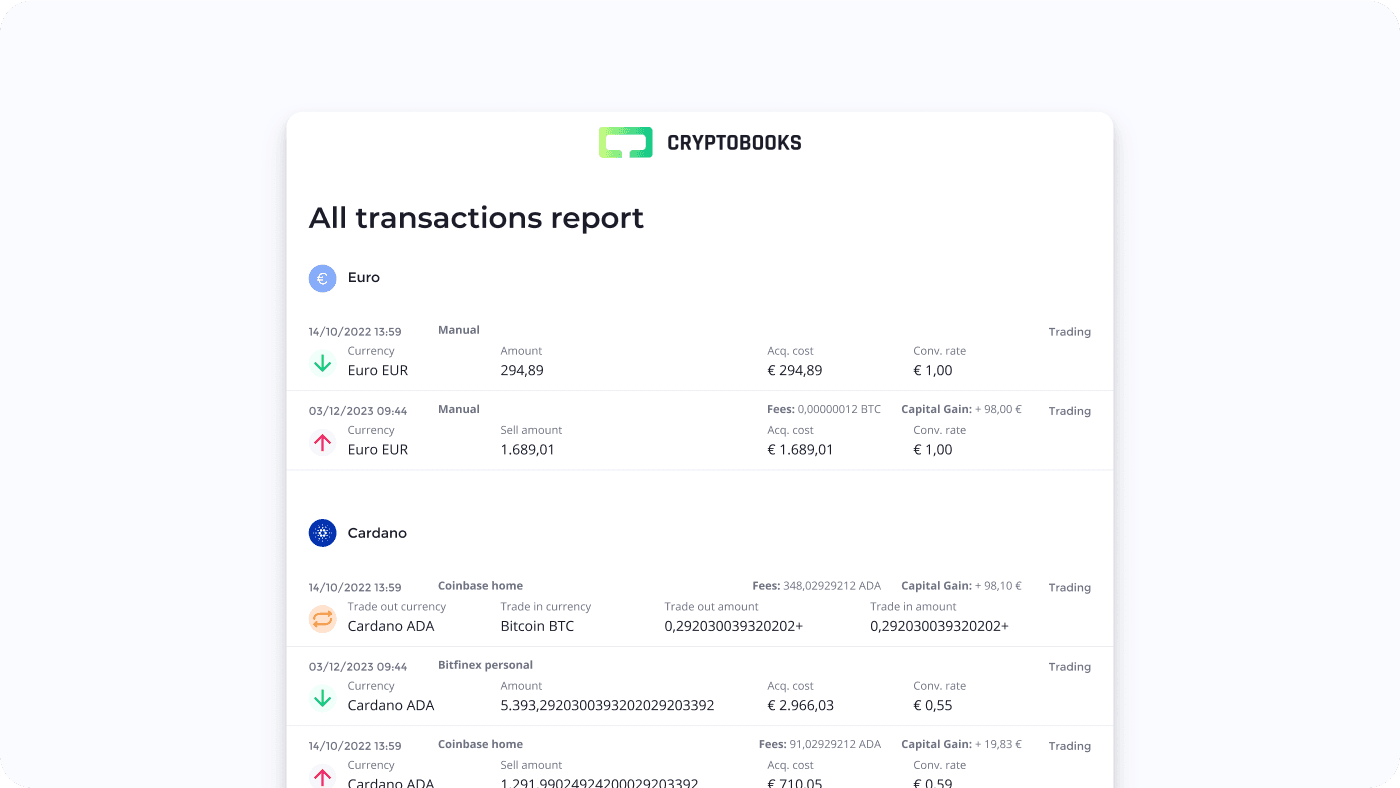

All transactions report

The report with all your transactions, perfectly reconciled and audit-proof, for the period you prefer.

Your reconciled transactions

Filter by time period

Clear and audit-proof

Useful for your accountant

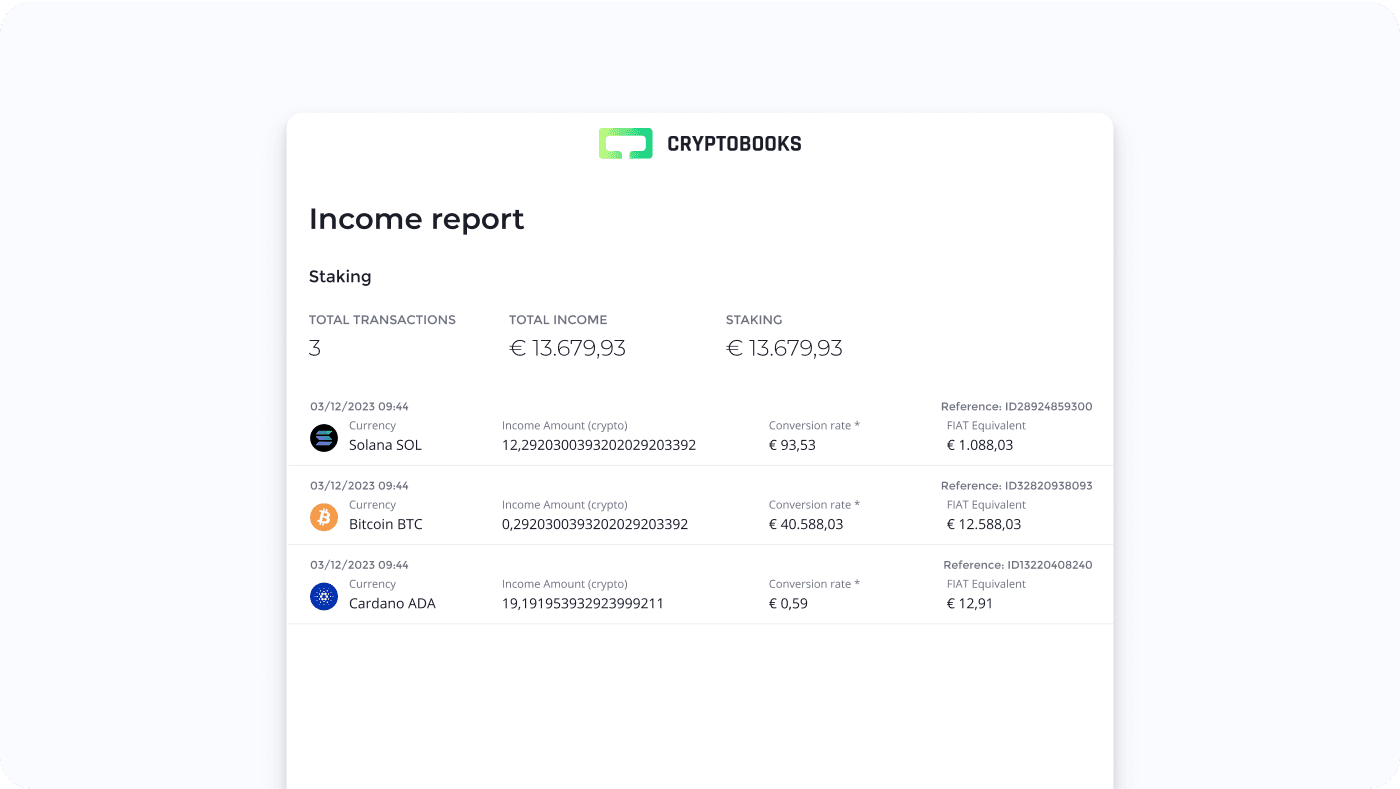

Income report

This essential report indicates all the income received in the period of your interest, whether it's from staking or other crypto-related work.

Staking income

Networking income in crypto

Income paid in crypto

Guidance for income tax return

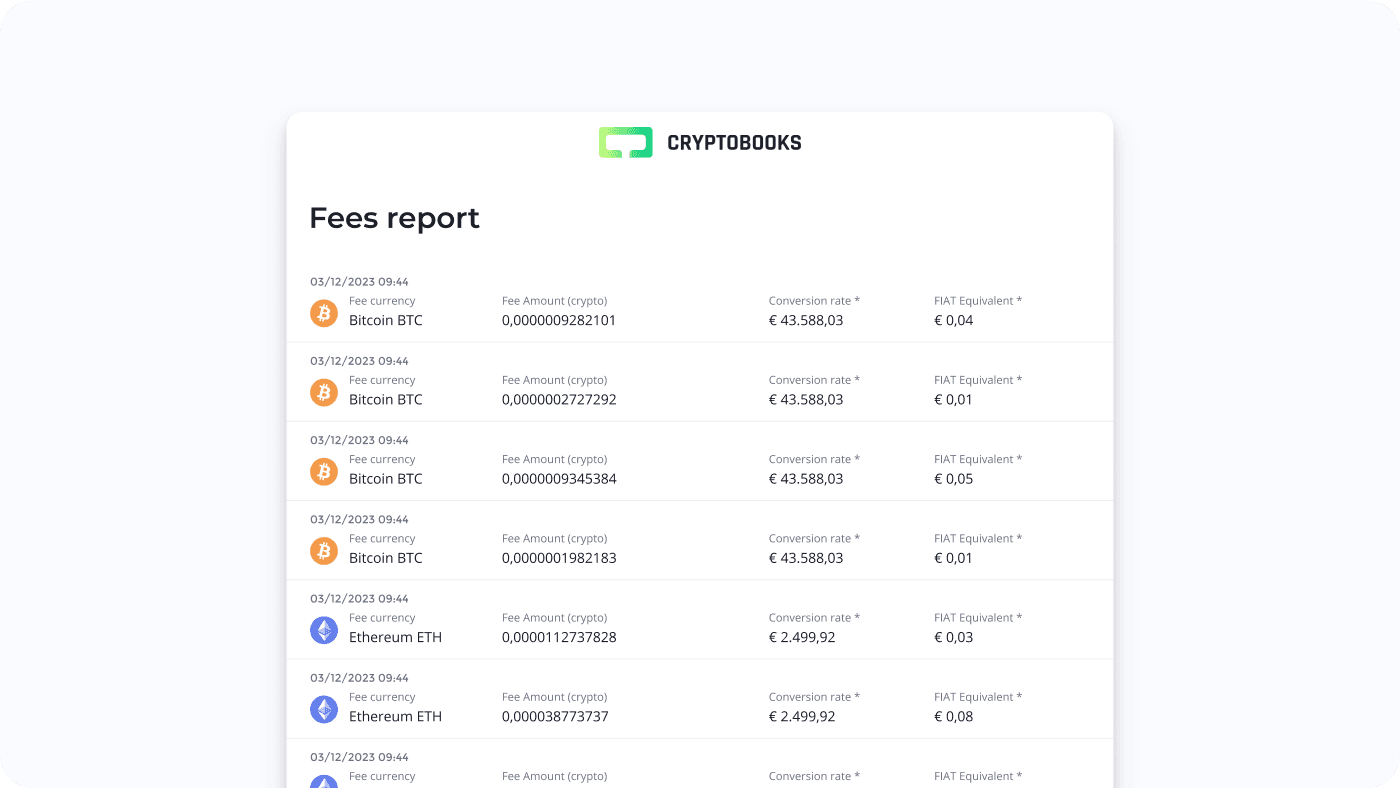

Fees report

In this document, you'll find a summary of the costs and fees you incurred while carrying out your crypto activities.

Exchange fees

Chain fees

Operating costs

Maximum control over your activities

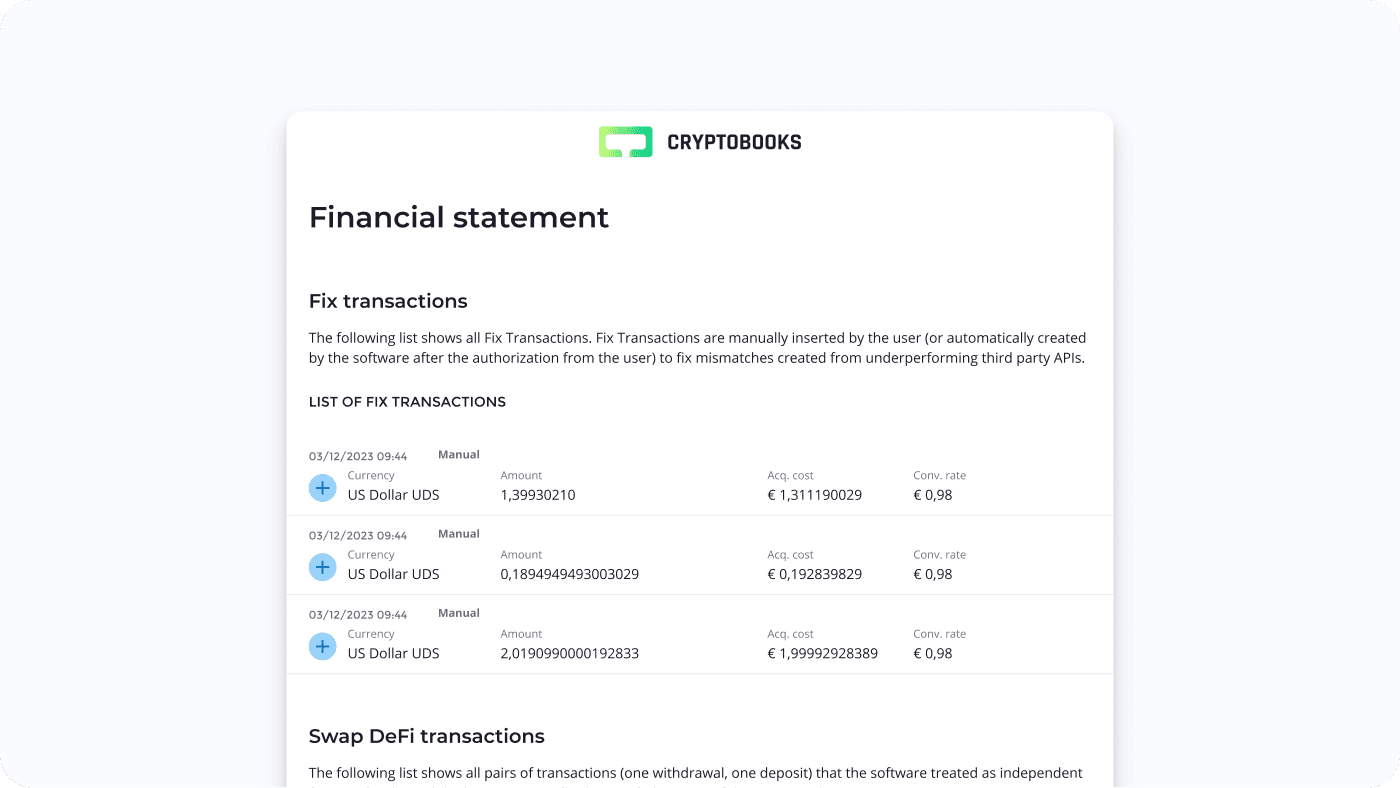

Financial statement

The Financial Statement explains the characteristics of quantitative values and calculation methods: in case of an audit, it allows you to be solid and transparent with tax authorities.

Highlight of manual operations

Details of calculations performed

Transparency and solidity

List of sources

Franca M.

The reports from CryptoBooks allowed me to fill out my tax return very easily. Fantastic

George B.

I completed my tax return with CryptoBooks reports. No need to say anything else.

Frances R.

5 stars because I managed to fill out my tax return just 2 days before the deadline thanks to cryptobooks... just had to connect my platforms, address the discrepancies indicated by the software, downloaded the report, and copied the data written there. Very easy but what actually impressed me is the accuracy, since the portfolio was perfectly aligned with my real wallets.

Matthew G.

Excellent, clear, simple, but above all, correct reports! Finally, a reliable product!

Paul M.

Fantastic guys at CryptoBooks, what can I say... the reports I downloaded are accurate, easy to read. I shared them with my accountant, and he asked for this software for other clients with crypto because he had never seen such good ones before. In short, highly recommended!

Frederick R.

I like to write reviews, especially when I'm satisfied with a product. The process involves several steps, it would take me a bit too long to write out all the details, but everything goes smoothly, and in summary, it's like this: thanks to an interface that guides you well and is simple, you connect the platforms, resolve the errors that are reported, check everything, and download the reports (they arrive via email, great: sending them to my accountant literally took 2 clicks) and the game is really done. What can I say, truly top-notch.