Taxation

14/10/2025

How to report Binance transactions with CryptoBooks

Using Binance in the UK? HMRC still expects a full tax report

You might think that using a global exchange like Binance makes tax reporting simpler. In reality, it often makes things more complicated. Every time you trade, swap tokens, stake assets, or use your Binance Card, you could be triggering a taxable event under UK law.

Binance allows you to trade hundreds of digital assets, earn yield through staking and savings, and even participate in new token launches. But while it simplifies access to the crypto market, it does not categorise or value transactions for tax purposes. HMRC now has extensive visibility into exchange data and expects accurate classification of each event, whether it’s a disposal, income, or capital gain.

So what happens if your Binance records don’t match HMRC’s expectations? Inconsistent or incomplete declarations can lead to backdated tax bills, interest, and penalties. Ensuring your reports reflect the full picture, including transfers, conversions, and staking, is crucial to staying compliant.

This guide walks you through how to interpret your Binance activity under HMRC rules, connect your account to CryptoBooks, and produce a complete and accurate tax report aligned with your Self Assessment obligations.

Main tax obligations on Binance

Using Binance does not exempt you from UK tax obligations. Under HMRC rules, every operation involving crypto must be reviewed to determine if it qualifies as a disposal or income event. Binance does not apply this logic for you, and its reports are not aligned with Self Assessment standards. Here is what you need to know.

Spot trading on Binance: disposals and capital gains

When you buy or sell crypto on the spot market, swap tokens, spend crypto through the Binance Card, or gift tokens to someone other than your spouse, HMRC treats these as disposals. Each disposal must be valued in pounds sterling at the time of the transaction.

Capital Gains Tax (CGT) applies to the profit or loss between the acquisition cost (using HMRC’s pooling and matching rules) and the disposal value. These gains and losses must be reported on Form SA108.

Binance does not calculate your capital gains or apply the UK-specific rules required by HMRC, such as share pooling, same-day matching, and the 30-day rule. These calculations must be performed by you to ensure full compliance.

Rewards: staking, savings, airdrops, and bonuses

If you receive crypto from Binance as a reward (for example, staking yield, savings interest, referral bonuses, or learn-to-earn incentives) this is generally classified as income by HMRC.

The GBP value of each reward at the time of receipt must be reported under Income Tax in your Self Assessment (SA100, Box 17). If you later sell or exchange the tokens, a separate capital gain or loss will apply based on the difference between the original value and the disposal amount.

Not all airdrops are taxable as income. Passive airdrops with no action required may enter the CGT regime directly with a £0 cost basis. Rewards received for providing services or engaging with the platform are taxable as income when received.

Futures and derivatives: separate treatment

Binance also allows trading in futures, options, and perpetual contracts. These products are financial derivatives and the tax treatment differs from spot trades.

For most individual investors, gains or losses from these products fall under Capital Gains Tax, declared on SA108. However, if your activity shows signs of being commercial in scale, such as high frequency, organisation, and profit motive, HMRC may treat it as a trading business. In this case, profits are taxed as trading income under Income Tax rules, and may also trigger National Insurance contributions.

Futures are typically cash-settled, and you do not take ownership of the underlying crypto. Nevertheless, each closed position creates a gain or loss that must be recorded and reported.

Your reporting duties: what Binance doesn’t do

Binance records your transactions, but it does not:

convert values to GBP;

classify disposals and income according to UK tax law;

apply share-pooling and matching rules;

generate Self Assessment-ready reports.

As a UK taxpayer, you are required to reconstruct your Binance history in line with HMRC’s framework. This includes calculating gains and income in GBP, categorising events correctly, and maintaining full records for each transaction.

The next section explains how to automate this process connecting CryptoBooks, ensuring accuracy and compliance without relying on manual spreadsheets.

Step-by-Step: how to connect Binance to CryptoBooks

To begin preparing your Binance data for HMRC reporting, the first step is to connect your account to CryptoBooks. Follow the steps below to set up the connection and start importing your transactions.

1. Create your CryptoBooks free account: sign up without entering card details. You can immediately access your dashboard and begin setting up your connections

2. Go to the Connections page: from the list of available platforms and wallets, choose Binance to start the setup process

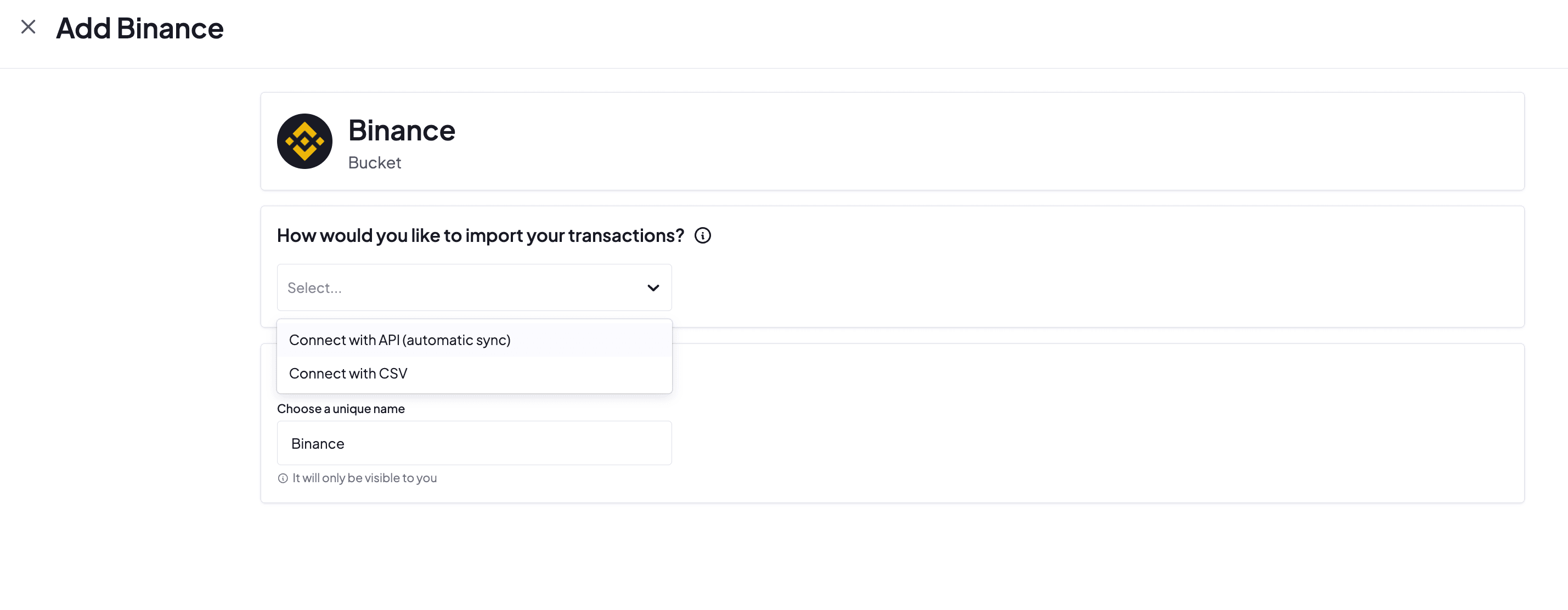

3. Choose your import method: API or CSV: you can connect using Binance’s API for automatic sync, or upload a CSV export if you prefer manual import. Both methods are read-only and secure.

4. Import your transaction history: CryptoBooks retrieves your complete Binance activity, including spot trades, staking rewards, Launchpad entries, derivatives and Binance Card usage.

5. Review and confirm classifications: each transaction is automatically categorised under HMRC rules, as capital gains, income, staking rewards, or other disposals; you can always review, adjust and ensure accuracy before finalising your report.

6. Generate your UK tax report: once verified, CryptoBooks compiles your data into a structured Self Assessment report, ready to file and compliant with HMRC standards.

You can create a free CryptoBooks account without entering any card details and start using it immediately. The free version lets you connect your Binance account, import all transactions, and review their classification under HMRC rules. A paid plan is then required when you decide to generate and download your official Self Assessment tax report, complete with all supporting documentation.

Key Guides to UK crypto tax compliance

If you are unsure how your crypto activity is taxed in the UK or want to double-check your reporting approach or consequences for not declaring, these essential guides provide detailed, up-to-date explanations based on HMRC rules:

Understanding these topics now can help you avoid common reporting errors, make the calculations correctly, and reduce the risk of penalties or future enquiries from HMRC.

CryptoBooks makes Binance tax return accurate

Using Binance means operating across multiple products: spot, staking, savings, NFTs, token launches, and more. Each of these can trigger a different type of taxable event under UK law. HMRC expects a complete report that classifies every transaction correctly and converts all values into pounds at the date of each event. Without a system that applies this logic, the task of reconstructing your full Binance history and do the correct calculations remains entirely on you.

CryptoBooks automates everything for you: it imports your Binance data, applies HMRC’s tax rules to each transaction and generates a Self Assessment report that reflects your actual tax position.

You can create a free account today, connect your Binance activity and prepare for your Self Assessment with accurate records and fully compliant reports.

Other contents for you

Taxation

08/08/2025

Crypto tax in the UK: what you need to know (2025 Guide)

Understand UK crypto tax rules for 2025. HMRC guidance, rates, allowances and how to report gains and income from crypto.

Taxation

19/08/2025

How to fill in Box 51 for crypto CGT

Box 51 is now key for crypto in 2024/25. HMRC requires it to split gains before and after 30 Oct’s CGT rate rise, or your tax will be wrong.

Taxation

01/09/2025

How HMRC treats DeFi activities in the UK (2025 update)

How HMRC taxes DeFi lending, staking and liquidity in the UK. Current rules trigger CGT on disposals; proposals may shift to income-only returns.

Taxation

16/09/2025

UK crypto staking tax 2024/25: how to report rewards and gains

Earn crypto through staking? In the UK rewards are taxable income and disposals may trigger CGT. Learn how to report them and use allowances.

We specialise in cryptocurrency bookkeeping

CryptoBooks calculates taxes on your cryptocurrencies with 100% accuracy, giving you the peace of mind of precise tax reports, ready to hand straight to your accountant.

Connect and reconcile all your platforms and wallets

You can connect all your platforms and wallets to CryptoBooks: the already integrated connections exceed 500, both through APIs and CSV. And if you don't find what you're looking for, you can create custom connections.

Monitor and verify your cryptocurrency transactions

Use guided procedures to resolve discrepancies quickly and effortlessly.

Download your cryptocurrency tax reports

Export your cryptocurrency tax reports for your accountant or use them directly in your Income Tax Return, as they are accurate and fully compliant with current UK tax laws