Taxation

27/10/2025

Avoid Kraken tax mistakes: a UK investor's guide

Trading or staking crypto through Kraken? As a globally regulated exchange, Kraken gives UK investors access to hundreds of digital assets. But while the platform simplifies trading and earning, it doesn’t handle your tax reporting. And that’s where mistakes begin.

Every crypto transaction you make on Kraken whether it’s a trade, conversion, or staking reward is recorded and traceable. HMRC now uses sophisticated blockchain and exchange data to cross-check reported income against actual activity. Even though Kraken operates as a regulated exchange, it doesn’t automatically calculate or submit your crypto taxes to HMRC. The responsibility to classify each transaction under UK tax law remains yours.

If your reported data doesn’t align with what HMRC already holds, you could face backdated tax bills, interest, or penalties.

This guide explains how UK crypto taxation applies to Kraken users, walks you through how to link Kraken to CryptoBooks for seamless tax automation, and shares practical tips to help you stay compliant, efficient, and stress-free throughout the tax year.

Understanding how your Kraken activity impacts UK crypto taxes

Kraken is a trusted platform for accessing global cryptocurrency markets, but when it comes to your UK tax responsibilities, the work doesn’t stop there.

As a regulated centralised exchange, Kraken lets users buy, sell, trade, and stake a wide range of digital currencies. However, every movement on your account, whether it’s a token swap, staking payout, or fiat withdrawal, can carry tax consequences under HMRC’s crypto tax framework.

Although Kraken offers downloadable transaction data, it doesn’t interpret these events for tax purposes. The exchange records the raw data, but you’re responsible for identifying how each activity is treated under UK tax law, for example:

swapping crypto for crypto counts as a disposal and could generate a Capital Gains Tax event;

staking or yield rewards are usually treated as taxable income;

bonuses, referral rewards, or airdrops may also be taxable upon receipt;

HMRC now has extensive visibility into crypto transactions through data-sharing agreements with exchanges and blockchain analytics firms. That means inconsistencies between your Self Assessment and HMRC’s records can result in penalties, interest charges, or amended assessments.

To simplify compliance, tools such as CryptoBooks can automate much of this process. By connecting your Kraken account via API or CSV, the platform pulls in your full trading history, categorizes each transaction according to HMRC’s latest guidance, and generates ready-to-submit tax summaries. It also consolidates your Kraken data with activity from other exchanges or wallets, ensuring your crypto portfolio is fully reconciled and HMRC-compliant.

Kraken provides a secure and efficient way to engage with digital assets, but your tax reporting duties remain your responsibility. With the help of CryptoBooks, you can turn complex transaction data into clear, accurate, and compliant tax reports, giving you peace of mind when filing your UK crypto taxes each year.

How to link your Kraken account to CryptoBooks for seamless HMRC reporting

Managing your UK crypto taxes doesn’t have to be complicated. With CryptoBooks, you can import and organise all your Kraken transactions in just a few minutes. Here’s how to set it up step by step:

Create your CryptoBooks account: sign up quickly and start using CryptoBooks for free, no card details or commitments required. You’ll get access to intuitive tax tools built specifically for UK crypto users;

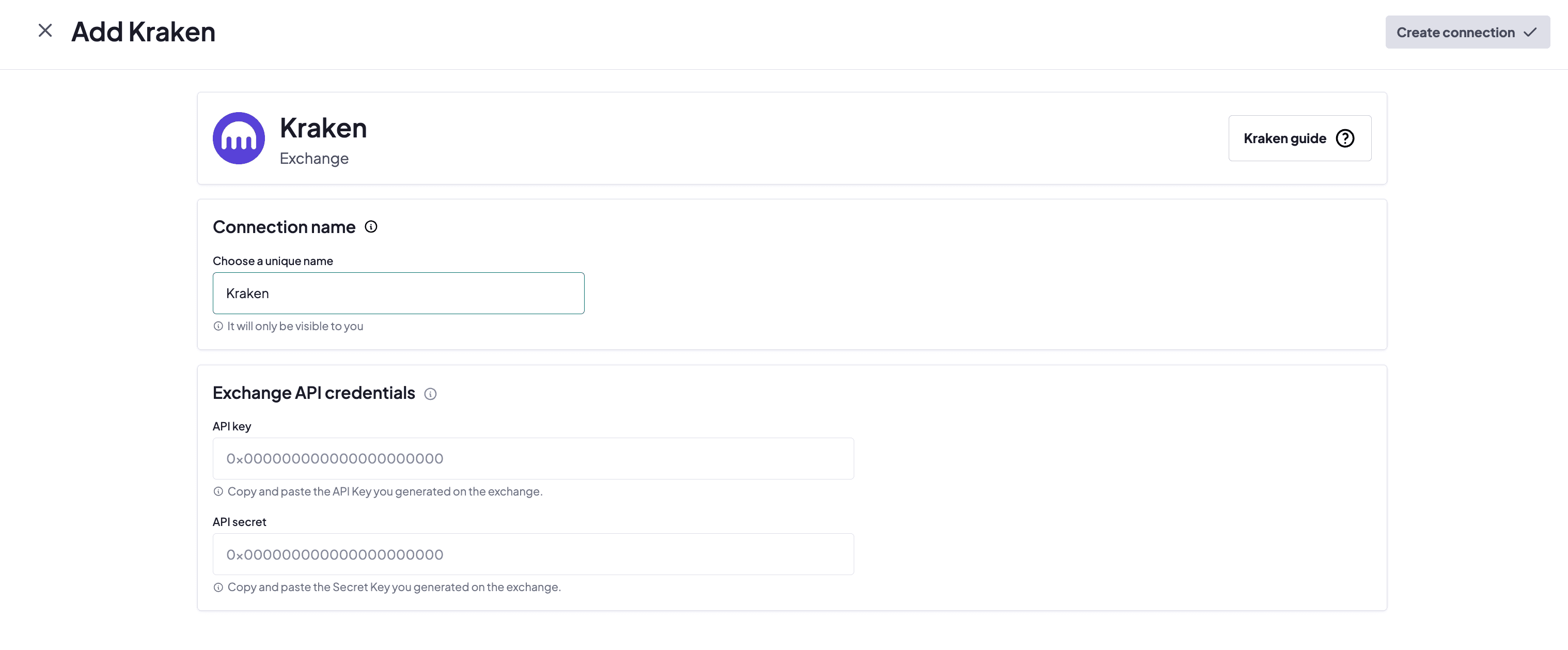

Add Kraken as a connection: from your CryptoBooks dashboard, open the Connections page and choose Kraken. The platform will walk you through a secure process to link your exchange account via an API connection;

enter your Kraken API details: paste your API key and API secret generated within Kraken. Your credentials remain private, CryptoBooks only requests read-only access, meaning it can import transaction data but cannot trade or withdraw funds;

import your Kraken activity automatically: once connected, CryptoBooks will automatically sync your complete history, including spot trades, deposits, withdrawals, staking rewards, and other on-exchange movements, without any manual uploads or spreadsheets;

review transaction classifications: each transaction is intelligently categorised according to HMRC crypto tax rules. You can review and adjust entries if needed to ensure every trade, swap, and income event is correctly interpreted for UK tax purposes.

generate a fully HMRC-compliant tax return: after reviewing your data, CryptoBooks compiles a ready-to-file Self Assessment report. Your crypto income, gains, and disposals are all clearly summarised, giving you complete confidence before submission.

With CryptoBooks, you can say goodbye to messy spreadsheets, missing records, and manual calculations. Your Kraken account remains secure, while CryptoBooks turns complex transaction data into clear, accurate UK tax reports, all in just a few clicks.

Need a quick refresher on UK crypto taxes?

Curious about how HMRC handles cryptocurrency? Whether you’re trading, staking, or earning rewards, understanding your tax obligations is essential.

Explore our in-depth guides for clear, straightforward explanations of how UK crypto tax works, from capital gains to income tax, and everything in between.

UK Crypto Tax Explained (2025 Update): A complete overview of how capital gains, crypto income, and Self Assessment reporting work in the UK.

Mastering Box 51 for Crypto Gains: Step-by-step guidance on splitting gains before and after the 30 October 2024 CGT rate change, and avoiding costly mistakes.

Staking Rewards and Taxes 2024/25: Learn how staking income is taxed, how to report it correctly, and make full use of applicable allowances.

DeFi in the UK: How HMRC Sees It (2025 Update): Get up to date on current CGT rules for DeFi transactions, and when your activity may count as taxable income.

Crypto Penalties (What Happens If You Don’t Report): Understand the risks of missed filings or errors, and how to resolve issues before HMRC intervenes.

CARF and Crypto Reporting from 2026: Prepare now for new rules: wallets and exchanges will automatically share transaction data with HMRC starting in 2026.

With CryptoBooks, you can handle all of this with ease, automated imports, accurate classifications, and ready-to-file HMRC reports, while keeping your wallets secure.

Streamline your Kraken tax reporting with CryptoBooks

Keeping track of your crypto activity on Kraken can quickly become overwhelming, especially if you’re trading often, staking tokens, or transferring funds between wallets. Yet HMRC requires one accurate, consolidated report that includes every trade, deposit, and withdrawal.

CryptoBooks simplifies that entire process. By connecting your Kraken account through a secure, read-only API, the platform automatically imports your complete transaction history, categorises each entry according to UK crypto tax rules, and generates a detailed report ready for your Self Assessment.

You stay in full control of your Kraken account, CryptoBooks only reads your data, never accessing or moving your funds. Behind the scenes, it handles all the calculations, classifications, and tax logic for you.

Get started today with a free CryptoBooks account and remove the stress from your Kraken tax reporting once and for all.

Other contents for you

Taxation

08/08/2025

Crypto tax in the UK: what you need to know (2025 Guide)

Understand UK crypto tax rules for 2025. HMRC guidance, rates, allowances and how to report gains and income from crypto.

Taxation

19/08/2025

How to fill in Box 51 for crypto CGT

Box 51 is now key for crypto in 2024/25. HMRC requires it to split gains before and after 30 Oct’s CGT rate rise, or your tax will be wrong.

Taxation

01/09/2025

How HMRC treats DeFi activities in the UK (2025 update)

How HMRC taxes DeFi lending, staking and liquidity in the UK. Current rules trigger CGT on disposals; proposals may shift to income-only returns.

Taxation

16/09/2025

UK crypto staking tax 2024/25: how to report rewards and gains

Earn crypto through staking? In the UK rewards are taxable income and disposals may trigger CGT. Learn how to report them and use allowances.

We specialise in cryptocurrency bookkeeping

CryptoBooks calculates taxes on your cryptocurrencies with 100% accuracy, giving you the peace of mind of precise tax reports, ready to hand straight to your accountant.

Connect and reconcile all your platforms and wallets

You can connect all your platforms and wallets to CryptoBooks: the already integrated connections exceed 500, both through APIs and CSV. And if you don't find what you're looking for, you can create custom connections.

Monitor and verify your cryptocurrency transactions

Use guided procedures to resolve discrepancies quickly and effortlessly.

Download your cryptocurrency tax reports

Export your cryptocurrency tax reports for your accountant or use them directly in your Income Tax Return, as they are accurate and fully compliant with current UK tax laws