Taxation

07/10/2025

How to report your Metamask taxes with CryptoBooks (complete guide)

Using MetaMask to trade, stake, or manage crypto across Ethereum, Binance Smart Chain, and Solana networks? You might assume that, because it’s a non-custodial wallet, your activity remains private. Yet every transaction is permanently inscribed on public blockchains, including those that fund your wallet, and HMRC now monitors crypto activity with unprecedented precision.

MetaMask acts as both a wallet and an access point to Web3: it lets you connect to decentralised applications, swap tokens, interact with smart contracts. Yet while the wallet simplifies these activities, it does not classify them for tax purposes. Knowing what each transaction represents under UK law (a disposal, an airdrop, staking income, or a capital gain) is what ensures compliance.

So what happens if your reports don’t match the data already in their hands? Failing to declare accurately can trigger backdated tax assessments, interests and penalties. This article unpacks how UK crypto taxation actually works, how to connect MetaMask to CryptoBooks for seamless reporting, and which compliance habits can help you protect your assets and peace of mind throughout the tax year.

What your MetaMask transactions mean for UK tax reporting

MetaMask gives you full control over your crypto, but it does not help you manage your tax reporting obligations.

As a non-custodial wallet, MetaMask lets you connect to multiple EVM-compatible networks such as Ethereum, BNB Chain, Base, Arbitrum, Optimism, using a single interface. However, each network keeps a separate record of your transactions. There are no account statements, no gain or income summaries, and no exportable reports tailored to UK requirements.

While the wallet provides a unified experience, the underlying data remains fragmented by chain. If you operate across several networks, you’ll need to retrieve and reconcile your activity on each one to build a complete tax picture.

That means it’s your responsibility to track what you did, when you did it, and how each transaction should be treated under UK tax law. MetaMask records the raw data, but it’s up to you to interpret, organise, and declare it correctly in your Self Assessment.

To simplify this process, avoid errors or omissions you can use CryptoBooks to connect your wallets and CEXs, including MetaMask wallet, and automatically structure your imported data. Here’s how it works.

Step-by-Step: how to connect MetaMask to CryptoBooks

Getting your MetaMask transactions HMRC-ready starts with a simple connection process. Here’s how it works:

Create your CryptoBooks account: sign up in a few clicks and create a free account, no card required;

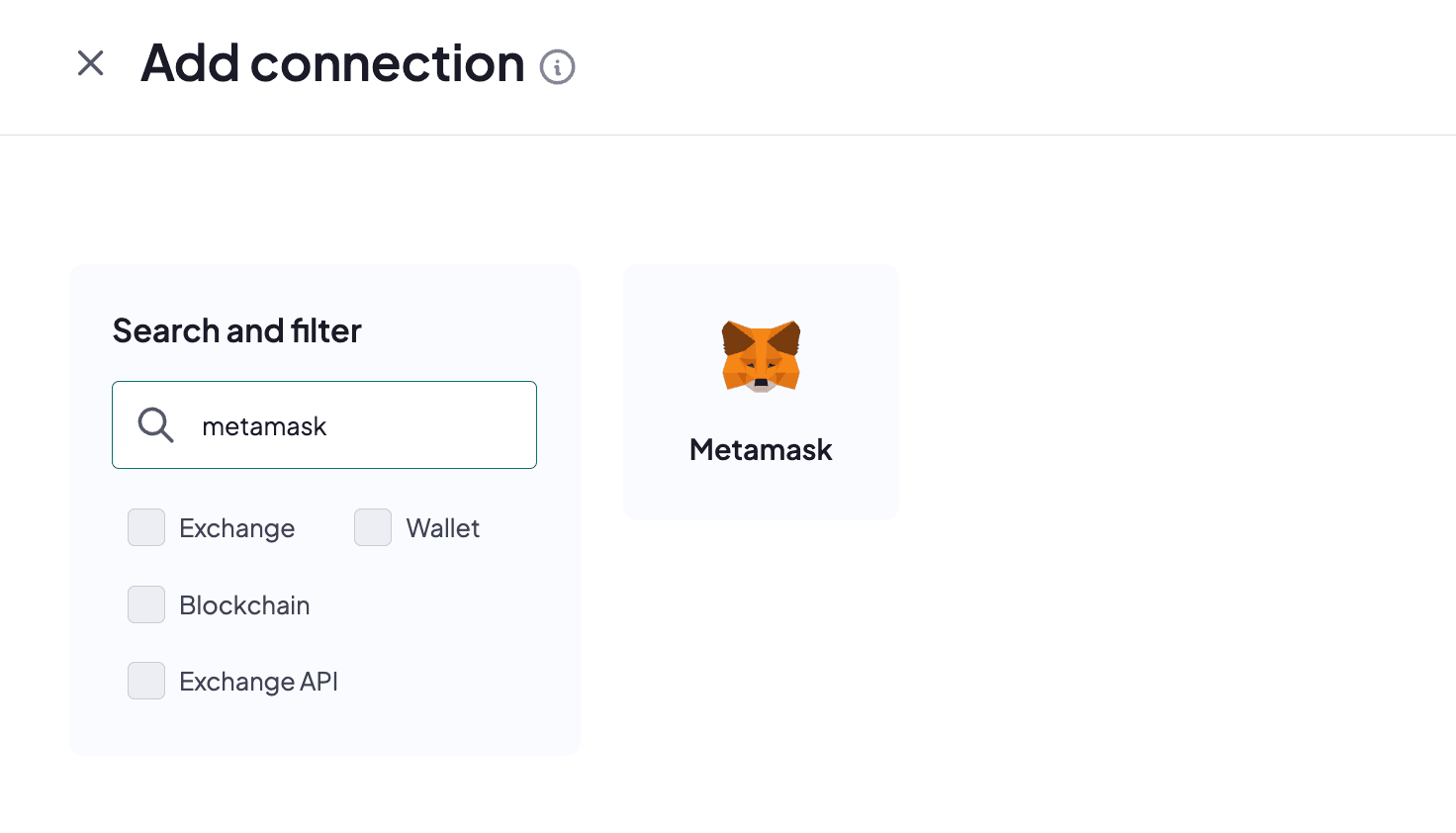

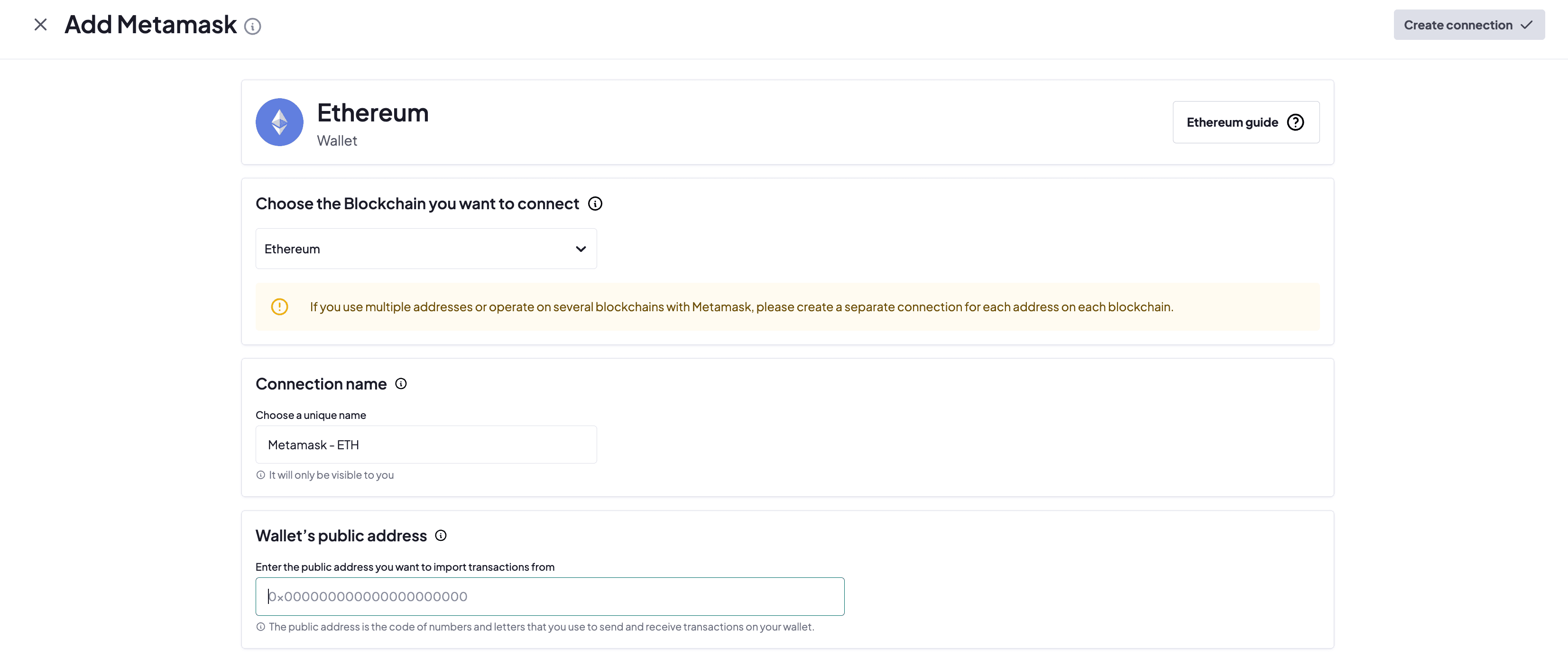

Go to Connections: look for the metamask wallet, or alternatively select the blockchain networks you’ve used;

Enter your public MetaMask address: paste your public address here, and always apply precaution: CryptoBooks nor any crypto taxation software will never ask or need you to share the private keys;

Automatic transaction import: CryptoBooks then retrieves your complete onchain history for that address, including swaps, staking rewards, DeFi activity, airdrops, NFTs, deposits and withdrawals;

Review and verify classifications: each transaction is automatically categorised according to UK HMRC rules. You can check that everything is correctly labelled and adjust manually if needed, before generating your report;

Generate your UK tax report: CryptoBooks compiles your classified data into a ready‑to‑file Self Assessment report, ensuring accuracy and full HMRC compliance.

With CryptoBooks, you can stop worrying about spreadsheets, lost transactions, or misclassifying gains. Your MetaMask wallet stays under your control, while CryptoBooks handles the complex tax calculations for HMRC compliance.

All wallet imports, transaction classification, and previews are available for free, while the paid plan is only required to generate and download your official tax report.

Need a crypto tax refresher?

Want to understand exactly how your crypto activity is taxed in the UK? Check out these articles:

Crypto Tax in the UK: what you need to know (2025 Guide) - Understand HMRC rules on capital gains, income, and how to report them via Self Assessment;

How to Fill in Box 51 for Crypto Gains - Learn how to split gains before and after the 30 October 2024 CGT rate change, and avoid filing errors;

UK Crypto Staking Tax 2024/25: How to Report Rewards and Gains - Find out how staking rewards are taxed, how to report them, and how to apply the right allowances;

How HMRC Treats DeFi Activities in the UK (2025 Update) - Understand current CGT rules on DeFi and why they might shift toward income taxation;

HMRC Crypto Penalties: What Happens If You Don’t Report Your Crypto in the UK - Missed a filing? Made a mistake? Here’s what to expect, and how to fix it before HMRC contacts you;

CARF and Crypto in the UK: What Changes from 2026 - Starting in 2026, wallets and exchanges will begin reporting your data. Here’s what to prepare for now.

CryptoBooks makes MetaMask tax compliance simple

Using MetaMask means managing your activity across multiple chains and protocols, but HMRC expects one structured, complete report. Without a system that reconstructs and classifies those movements correctly, the burden of reconciling everything, from dates, to values and categories, falls entirely on you.

CryptoBooks fills that gap. It imports your MetaMask history, applies HMRC rules to each transaction, and transforms it into a Self Assessment report aligned with UK tax rules. You keep full control of your wallet and you decide how to handle your taxes manually, or with the right tools.

To see how it works and start preparing your report, create your free CryptoBooks account.

Other contents for you

Taxation

08/08/2025

Crypto tax in the UK: what you need to know (2025 Guide)

Understand UK crypto tax rules for 2025. HMRC guidance, rates, allowances and how to report gains and income from crypto.

Taxation

19/08/2025

How to fill in Box 51 for crypto CGT

Box 51 is now key for crypto in 2024/25. HMRC requires it to split gains before and after 30 Oct’s CGT rate rise, or your tax will be wrong.

Taxation

01/09/2025

How HMRC treats DeFi activities in the UK (2025 update)

How HMRC taxes DeFi lending, staking and liquidity in the UK. Current rules trigger CGT on disposals; proposals may shift to income-only returns.

Taxation

16/09/2025

UK crypto staking tax 2024/25: how to report rewards and gains

Earn crypto through staking? In the UK rewards are taxable income and disposals may trigger CGT. Learn how to report them and use allowances.

We specialise in cryptocurrency bookkeeping

CryptoBooks calculates taxes on your cryptocurrencies with 100% accuracy, giving you the peace of mind of precise tax reports, ready to hand straight to your accountant.

Connect and reconcile all your platforms and wallets

You can connect all your platforms and wallets to CryptoBooks: the already integrated connections exceed 500, both through APIs and CSV. And if you don't find what you're looking for, you can create custom connections.

Monitor and verify your cryptocurrency transactions

Use guided procedures to resolve discrepancies quickly and effortlessly.

Download your cryptocurrency tax reports

Export your cryptocurrency tax reports for your accountant or use them directly in your Income Tax Return, as they are accurate and fully compliant with current UK tax laws