Taxation

03/11/2025

How to report your Rabby wallet taxes with CryptoBooks

Using Rabby wallet to trade, bridge, or manage crypto across multiple DeFi protocols and chains? You might think that self-custody gives you privacy, but every transaction remains permanently visible on public blockchains. HMRC already tracks wallet activity and exchange data through blockchain analytics and international data sharing, but tax reporting remains your responsibility.

Every time trigger a taxable event under UK law. HMRC expects a clear breakdown of every disposal and income event, even when these happen outside a centralised exchange.

Rabby story your crypto. CryptoBooks helps you track and declare every movement for your tax position. This guide explains how to report your DeFi and wallet activity through CryptoBooks, ensuring your Rabby transactions are accurately classified and HMRC-ready.

Consequences of failing to report your crypto held on Rabby

Using a self-custody wallet like Rabby doesn’t mean HMRC can’t see or investigate your crypto activity. In fact, failing to declare your crypto transactions correctly can lead to serious legal and financial consequences in the UK.

Here’s what can happen if you don’t report your crypto income or capital gains:

Tax penalties and interest

HMRC can impose substantial penalties for undeclared crypto gains or income. These may include:

òate filing penalties if you miss the Self Assessment deadline.

inaccuracy penalties (up to 100% of the unpaid tax) if HMRC determines you deliberately provided incorrect information.

interest charged on any unpaid tax from the date it was due.

Backdated tax investigations

HMRC has the right to investigate several years of past tax returns. If you fail to report crypto activities, they can review your wallet activity, exchange records, and even blockchain data to assess your liability.

Self-custody wallets like Rabby don’t hide you from HMRC, blockchain transparency means transactions can still be traced and linked to your identity.

Loss of HMRC leniency

If you voluntarily disclose undeclared crypto gains, HMRC is often more lenient and may reduce penalties. However, if they discover the omission first, the penalties can be far higher, and leniency is unlikely.

Impact on future financial Standing

Tax evasion records can affect your creditworthiness, ability to apply for mortgages, or even your professional status if you work in a regulated industry (e.g., finance or law).

Not declaring your crypto from Rabby doesn’t make it invisible, it just increases your risk. HMRC expects full transparency, even from self-custody wallets. The safest approach is to accurately report every gain, loss, or reward in GBP on your annual tax return.

Limitations of Rabby and How CryptoBooks Fills the Gap

While Rabby gives you a clear record of all your on-chain activity, it doesn’t handle the complexities of UK tax compliance. Specifically, Rabby does not:

Convert your crypto transactions into GBP at the time of each event,

Apply HMRC’s pooling, same-day, or 30-day matching rules,

Categorise transactions correctly as capital gains, disposals, or income, or

Generate Self Assessment, ready reports for HMRC.

This is where CryptoBooks makes the difference. It takes your raw Rabby transaction history and transforms it into structured, HMRC-compliant tax records, automatically calculating gains, losses, and income in pounds. With CryptoBooks, your wallet data becomes a ready-to-file Self Assessment report, saving you hours of manual work and ensuring your crypto taxes are fully accurate and compliant.

How to Integrate Your Rabby Wallet with CryptoBooks

Getting your Rabby activity ready for UK tax reporting is simple.

Here’s how to do it:

create your free CryptoBooks account: no card details required. You can explore your dashboard immediately;

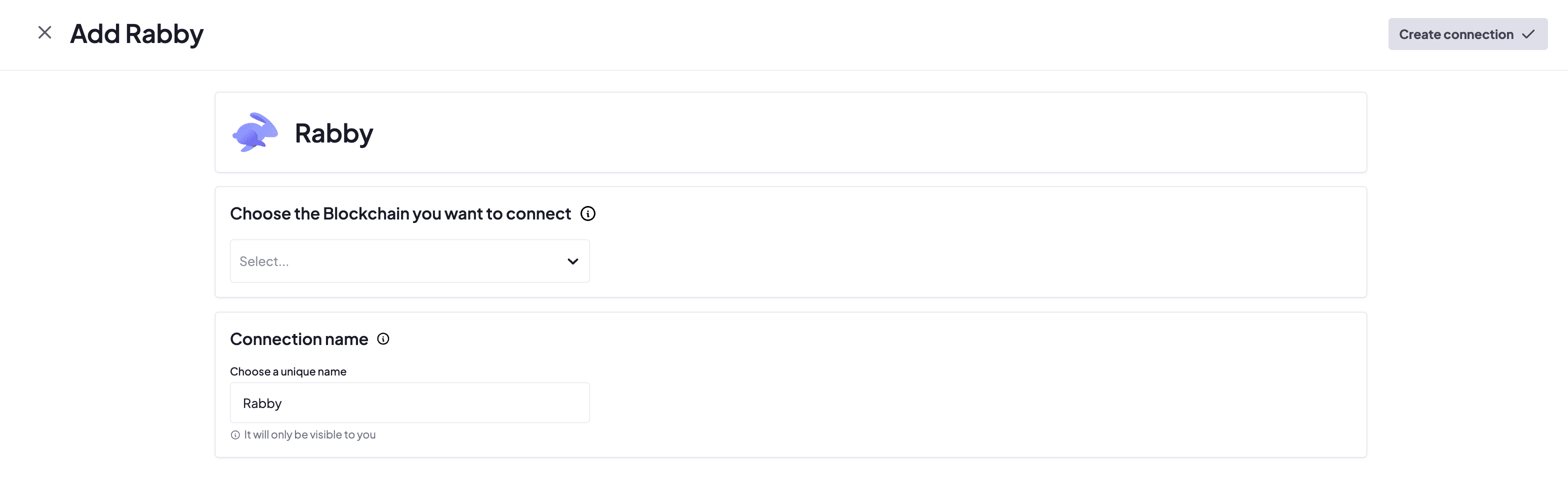

go to Connections: choose Rabby Wallet or import your wallet address manually;

connect securely via public address: CryptoBooks only needs read-only blockchain access; your private keys remain yours;

automatic transaction import: all swaps, staking rewards, NFT sales, and transfers across connected chains are imported automatically;

review classifications: transactions are automatically sorted into HMRC categories: disposals, income, rewards, or airdrops. You can edit or confirm each if needed;

generate your UK tax report: CryptoBooks compiles your complete Rabby activity into a ready-to-file Self Assessment report (SA100 + SA108), complete with supporting details.

With the free account, all imports, previews, and classifications are free. A paid plan is required only to generate and download your official HMRC report.A paid plan is only needed when you decide to generate and download your official tax report.

Essential UK crypto tax guides

Before submitting your report, it’s worth reviewing these up-to-date resources from CryptoBooks:

Crypto Tax in the UK: what you need to know (2025 Guide) - Understand HMRC rules on capital gains, income, and how to report them via Self Assessment;

How to Fill in Box 51 for Crypto Gains - Learn how to split gains before and after the 30 October 2024 CGT rate change, and avoid filing errors;

UK Crypto Staking Tax 2024/25: How to Report Rewards and Gains - Find out how staking rewards are taxed, how to report them, and how to apply the right allowances;

How HMRC Treats DeFi Activities in the UK (2025 Update) - Understand current CGT rules on DeFi and why they might shift toward income taxation;

HMRC Crypto Penalties: What Happens If You Don’t Report Your Crypto in the UK - Missed a filing? Made a mistake? Here’s what to expect, and how to fix it before HMRC contacts you;

CARF and Crypto in the UK: What Changes from 2026 - Starting in 2026, wallets and exchanges will begin reporting your data. Here’s what to prepare for now.

CryptoBooks makes Rabby wallet tax return effortless

With Rabby, your crypto activity spans multiple chains and DeFi platforms, meaning dozens (or hundreds) of potential taxable events each year. HMRC expects every disposal, income, and reward to be reported in pounds sterling, at the time it occurred.

Manually tracking all of this is nearly impossible. CryptoBooks automates it.

By connecting your Rabby wallet, CryptoBooks:

imports the complete onchain history for every chain you've interacted with;

applies HMRC’s share-pooling and matching logic,

categorises income vs capital events;

produces a compliant Self Assessment report ready to file.

No more complicated spreadsheets and manual calculatiors. Just accurate, automated accounting that keeps your crypto record clean.

Start today: create your free CryptoBooks account, connect your Rabby wallet, and prepare your 2024/25 HMRC tax report in minutes, confidently, accurately, and stress-free.

Other contents for you

Taxation

08/08/2025

Crypto tax in the UK: what you need to know (2025 Guide)

Understand UK crypto tax rules for 2025. HMRC guidance, rates, allowances and how to report gains and income from crypto.

Taxation

19/08/2025

How to fill in Box 51 for crypto CGT

Box 51 is now key for crypto in 2024/25. HMRC requires it to split gains before and after 30 Oct’s CGT rate rise, or your tax will be wrong.

Taxation

01/09/2025

How HMRC treats DeFi activities in the UK (2025 update)

How HMRC taxes DeFi lending, staking and liquidity in the UK. Current rules trigger CGT on disposals; proposals may shift to income-only returns.

Taxation

16/09/2025

UK crypto staking tax 2024/25: how to report rewards and gains

Earn crypto through staking? In the UK rewards are taxable income and disposals may trigger CGT. Learn how to report them and use allowances.

We specialise in cryptocurrency bookkeeping

CryptoBooks calculates taxes on your cryptocurrencies with 100% accuracy, giving you the peace of mind of precise tax reports, ready to hand straight to your accountant.

Connect and reconcile all your platforms and wallets

You can connect all your platforms and wallets to CryptoBooks: the already integrated connections exceed 500, both through APIs and CSV. And if you don't find what you're looking for, you can create custom connections.

Monitor and verify your cryptocurrency transactions

Use guided procedures to resolve discrepancies quickly and effortlessly.

Download your cryptocurrency tax reports

Export your cryptocurrency tax reports for your accountant or use them directly in your Income Tax Return, as they are accurate and fully compliant with current UK tax laws