Taxation

08/01/2026

The ticking clock: mastering your UK crypto tax return before the deadline

For years, the world of cryptocurrency felt like a financial Wild West, unregulated, anonymous, and largely ignored by tax authorities. Those days are over. Since 2018, His Majesty's Revenue and Customs (HMRC) has solidified its stance: crypto is not currency, it is property.

This distinction changes everything. It means that many actions you take with your digital assets, such as selling, swapping, staking, or spending them, can have tax implications, while others, like buying with GBP or transferring between wallets you own, do not. As the deadline for Self Assessment looms, the burden of proof falls entirely on you.

Here is everything you need to know to navigate the UK crypto tax landscape, avoid penalties, and simplify your reporting.

The rules of engagement: what is actually taxable?

A common and dangerous misconception among UK investors is that you only pay tax when you "cash out" to British Pounds (GBP). This is false.

HMRC does not view cryptocurrency as money; they view it as property (or a "chargeable asset"), similar to shares or a second home. This means the tax authorities look at the nature of the transaction, not just the end result. Every time you swap, spend, gift (outside a spouse or civil partner), or earn a digital asset, you may be triggering a taxable event, while transfers between wallets you own are not disposals.

Your liability generally falls into two buckets: Capital Gains Tax (CGT) or Income Tax. Understanding the difference is critical, as they are taxed at different rates and reported in different sections of your Self Assessment.

Capital gains tax (the "disposal" rule)

Capital Gains Tax applies to the profit you make when you "dispose" of an asset. In the eyes of HMRC, a "disposal" isn't just selling for cash, it’s any time you relinquish ownership of a token in exchange for something else.

Selling Crypto for Fiat (GBP, USD, EUR): This is the most obvious scenario. If you bought Bitcoin for £10,000 and sold it later for £15,000, you have a taxable gain of £5,000.

Example: You sell 1 BTC on Coinbase and withdraw the cash to your Barclays account. In this case, the taxable amount is the difference between the sale price and your original purchase price (cost basis).

Swapping Crypto for Crypto (The Silent Tax Trap): This is where many investors get caught out. When you swap one cryptocurrency for another, such as exchanging Bitcoin for Ethereum, HMRC treats it as two separate transactions. Essentially, you are considered to have sold the first token for its market value in GBP and then immediately used that value to purchase the second token. This means a taxable event occurs on the “sale” of the first token, even though no cash actually changes hands, and any gains must be reported for capital gains tax purposes.

Example: You bought 1 BTC years ago for £5,000. Today, it is worth £40,000. You decide to swap that 1 BTC directly for 20 ETH. Even though £0 hit your bank account, HMRC sees this as you "selling" your BTC for £40,000. You now owe Capital Gains Tax on the £35,000 profit.

Spending Crypto on Goods or Services: Using crypto to buy a coffee, a Tesla, or an NFT is technically a disposal. You are "trading" the crypto for the item.

Example: You use a crypto debit card to buy a £3,000 laptop using Litecoin (LTC) that you bought years ago for £200. You didn't just buy a laptop; you realised a capital gain of £2,800 on your Litecoin. You must report this gain.

Gifting Crypto: The tax implications of gifting cryptocurrency depend on who receives it. If you gift crypto to a spouse or civil partner, the transfer is generally tax-free, and they inherit your original cost basis. This approach is often used so that a later disposal can potentially use the recipient’s Annual Exempt Amount and tax bands. However, if you gift crypto to anyone else, it is considered a taxable event. For example, if you give 1 ETH to your brother, HMRC treats it as if you sold the ETH at its market value at the moment of the gift, meaning you must pay capital gains tax on the gain, even though no money was received.

Income tax (the "earnings" rule)

If your crypto holdings are generating new tokens for you, this is often treated like earning interest or a salary. You pay Income Tax on the Fair Market Value (GBP) of the tokens at the moment you receive them.

Staking Rewards & Yield Farming: Rewards from Proof-of-Stake blockchains (like Ethereum or Solana) or DeFi yield farming protocols are widely considered "Miscellaneous Income."

Example: Suppose you stake 100 DOT and earn 1 DOT as a reward every week. The rule is that each week you must record the GBP value of that 1 DOT at the time you receive it. Since the price of DOT can fluctuate, the value of your income changes accordingly. At the end of the tax year, the total GBP value of all the rewards you’ve received is added to your taxable income and must be reported for tax purposes; if you later sell or swap those reward tokens, a separate Capital Gains Tax calculation can also apply.

Airdrops: The tax treatment of airdrops depends on how you received them. If you had to take an action to qualify, such as retweeting a post, joining a Discord, or interacting with a protocol, HMRC treats the tokens as payment for a service, meaning they are subject to Income Tax. In contrast, if tokens simply appeared in your wallet without any action on your part, they may not be treated as income; instead, Capital Gains Tax would typically apply only when you eventually sell them, using a cost basis of £0. This area is complex, so it is important to check the specific HMRC guidance for each case.

Example (taxable airdrop): You receive 100 XYZ tokens for completing a task, and their market value at the time is £200. That £200 counts as income and must be reported for Income Tax.

Example (non-taxable airdrop): You receive 50 ABC tokens worth £150 simply for holding another token. You do not pay tax at receipt, but Capital Gains Tax can apply when you sell, using an allowable cost determined under HMRC guidance based on the specific facts.

Mining: the tax treatment of cryptocurrency mining depends on the scale and purpose of your activities. If you mine casually at home as a hobby, the rewards are generally treated as Miscellaneous Income and should be reported accordingly. However, if you operate a mining farm or have an organized, commercial operation, the activity is considered Trading Income, subject to Income Tax and National Insurance contributions.

Example (hobby mining): You mine a few ETH at home using a personal computer. The value of the coins received is reported as Miscellaneous Income on your tax return.

Example (business mining): You run multiple rigs in a dedicated facility, maintaining organized records and selling mined coins regularly. The profits are treated as Trading Income, subject to standard Income Tax rates and National Insurance contributions.

Employment Income: If your employer pays you in USDT, Bitcoin, or tokens, this is treated exactly like a salary ("Money's Worth"). You owe Income Tax and National Insurance on the GBP value of the crypto on payday.

The calculation trap: why spreadsheets often fail

If you are an active investor, calculating your tax liability manually is a near-impossible task. This is not just because of the volume of transactions, but due to HMRC’s strict Share Pooling and Matching Rules.

Many investors assume they can simply choose which Bitcoin they sold, typically the one that gives them the lowest tax bill (e.g., "I sold the Bitcoin I bought yesterday at the high price, so I made a loss"). HMRC does not allow this.

Instead, you must apply a strict hierarchy of rules to determine exactly which coin you disposed of. These rules are applied automatically, in this specific order:

The "Same-Day" Rule: HMRC first looks at transactions made within the same 24 hours. If you buy and sell the same token on the same day, these are matched together instantly. You cannot claim to hold a "cheaper" coin bought months ago if you repurchased the asset later that same evening.

The 30-Day Rule ("Bed and Breakfasting"): This anti-avoidance measure prevents you from artificially creating a tax loss. If you sell a token and buy it back within 30 days, HMRC ignores your original historical cost and matches your sale to the new purchase price, rendering your tax planning useless.

The Section 104 Pool: Any assets not matched by the first two rules fall into a single "pool." You do not own distinct coins; you own a weighted average cost of all your holdings. A single calculation error in 2021 will ripple forward, making every subsequent tax calculation for that asset incorrect.

Additionally, UK law requires every variable, asset price, trading fees, and gas fees, to be converted into Sterling at the exact moment of the transaction. For a single DeFi swap, you must calculate the GBP value of the token sold, the token bought, and the ETH spent on gas (which is treated as a disposal and may result in a capital gain or loss depending on its cost basis).

Deadlines, rates, and penalties

For the 2024/25 tax year (covering activity from 6 April 2024 to 5 April 2025), you are effectively dealing with two different tax regimes in a single year. The Autumn Budget 2024 introduced an immediate rate hike that splits your reporting year in half.

The "split year" rates (2024/25)

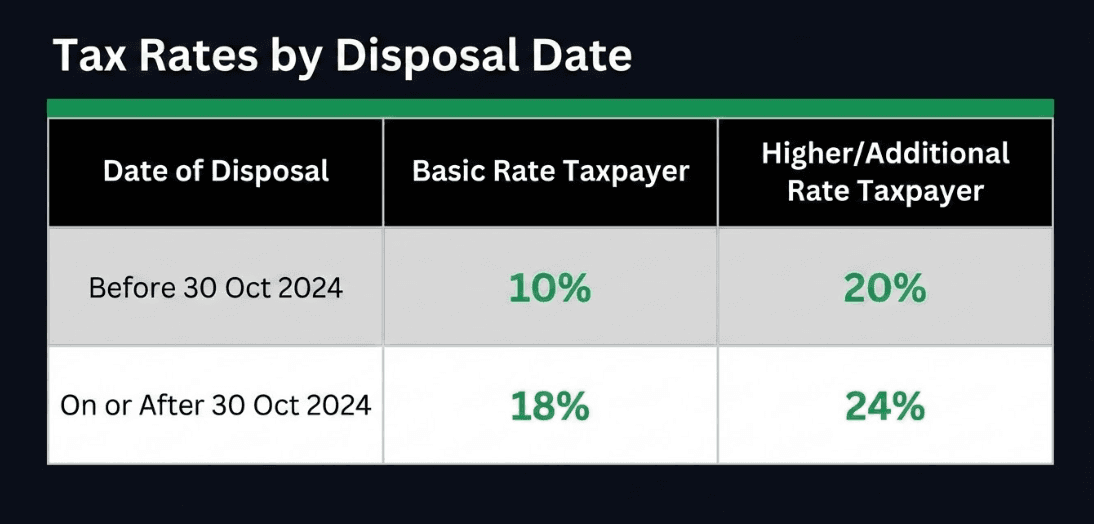

For the 2024/25 tax year, investors face a unique compliance hurdle: the tax year is effectively split in two. Unlike previous years where a single Capital Gains Tax rate applied to all profits, the Autumn Budget 2024 introduced an immediate rate hike that requires you to separate every single disposal based on the specific date it occurred.

With the Annual Exempt Amount now fixed at just £3,000, any profit exceeding this threshold is subject to strictly different rates depending on the timing of the transaction. Because the main Capital Gains Tax rates changed during the year, disposals must be calculated with reference to their dates so the correct pre- and post-change rates apply.

This creates a dangerous trap for the unprepared. If your disposals are not dated and calculated correctly in your Self Assessment, the Capital Gains Tax adjustment for 2024/25 can be wrong, leading to an incorrect tax liability. It is essential to isolate the gains from the first half of the year to lock in the lower rate, rather than letting an automated calculation default to the new, higher percentage for the total amount.

Example: Consider a scenario where you sold £10,000 worth of Bitcoin in September 2024 and £5,000 of Ethereum in December 2024. Even though both sales happened in the same tax year, the September gains are taxed at the lower rate (10% or 20%), while the December gains attract the higher rate (18% or 24%). This distinction must be explicitly detailed in your tax return to ensure you do not overpay tax on the earlier transaction.

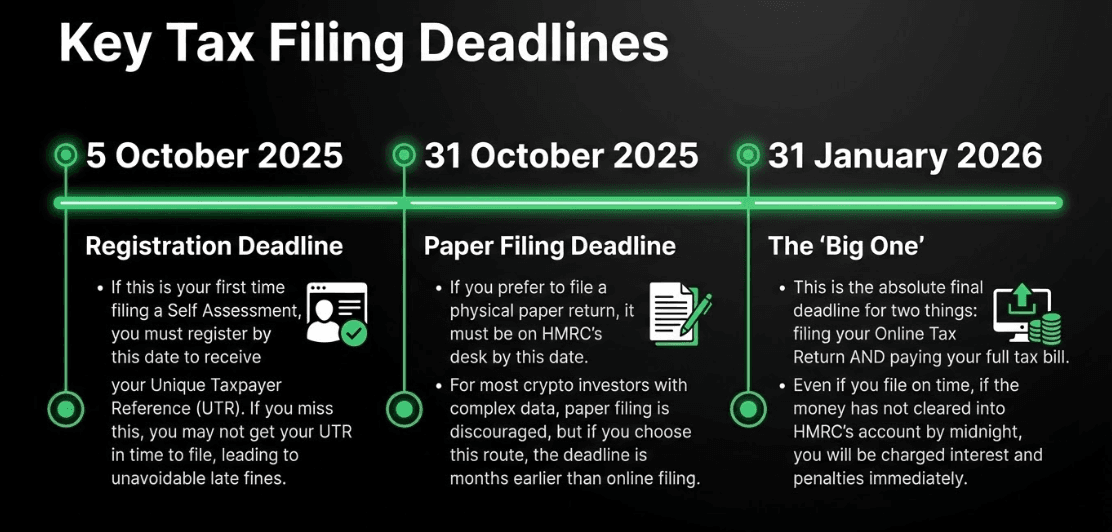

Critical deadlines

Do not underestimate the importance of these dates. HMRC operates on a strict schedule, and claiming ignorance ("I didn't know") is never accepted as a valid defense against penalties. Mark these in your calendar immediately.

The cost of non-compliance

HMRC has significantly ramped up its enforcement capabilities. Under the newly introduced UK Crypto-Asset Reporting Framework (CARF), starting from 1 January 2026, cryptoasset service providers will be required to report user and transaction data, with the first reports expected in 2027 for 2026 activity.

If you fail to report or pay on time, the costs escalate quickly:

Late filing penalties (the "clock" fines)

These apply automatically if your return is late, even if you have no tax to pay or have already paid your liability. The fines stack on top of each other as time passes:

1 Day Late: £100 fixed penalty immediately.

3 Months Late: £10 per day is added (up to £900).

6 Months Late: 5% of tax due (or £300, whichever is greater).

Late payment penalties (the "surcharges")

Even if you submit your paperwork perfectly on time, failing to settle the bill by the deadline triggers a separate tier of fines known as "surcharges." These are percentage-based penalties that target your outstanding balance:

30 Days Late: 5% of unpaid tax.

6 Months Late: Additional 5% of unpaid tax.

12 Months Late: Additional 5% of unpaid tax.

When combined, you could end up paying an extra 15% on top of your original tax bill purely in administrative fines, before interest is even calculated.

Interest (the hidden cost)

Interest is the silent accumulator that runs in the background, regardless of whether you have been fined or not. It is treated as commercial restitution, effectively the cost of "borrowing" the tax money from the government past the deadline:

Status: Charged daily from 1 February.

Rate: Bank of England base rate plus 4%

Interest accrues daily on any unpaid balance from the due date. This means your debt to HMRC grows every single morning you delay.

Inaccuracy penalties (the "behavior" tax)

If you submit a return that HMRC later proves was incorrect, you face an additional penalty based on your intent. HMRC does not penalize innocent mistakes if you took "reasonable care," but they punish carelessness and fraud severely:

Careless Error: 0% to 30% of the extra tax due. (Applies if you simply failed to take reasonable care, such as bad record-keeping or calculation errors).

Deliberate (Not Concealed): 20% to 70% of the extra tax due. (Applies if you knowingly submitted a wrong figure but did not actively try to hide the evidence).

Deliberate & Concealed: Up to 100% of the extra tax due. (Applies if you took active steps to hide the money, such as moving assets to a non-reporting offshore jurisdiction or falsifying documents. In this scenario, your tax bill effectively doubles).

The era of ambiguity is over. Protect your wealth with CryptoBooks

The days of "flying under the radar" are officially behind us. With HMRC applying strict property laws to digital assets and new global data-sharing agreements coming into force, compliance is no longer just a legal box to tick, it is the single most important step you can take to safeguard the portfolio you have worked hard to build. But strict rules do not have to mean sleepless nights.

Turn Compliance Into Your Advantage. You didn't enter the crypto market to become a part-time accountant. Don’t let the complexity of "Split Year" rates or Section 104 pools overshadow your investment success. By automating the heavy lifting, you transform tax season from a source of anxiety into a simple administrative routine.

Sign up for CryptoBooks for free to instantly aggregate your wallets, visualize your real-time tax exposure, and generate precise, HMRC-compliant reports in minutes. Stop guessing what you owe, and start reporting with the absolute confidence of a professional.

Other contents for you

Taxation

08/08/2025

Crypto tax in the UK: what you need to know (2025 Guide)

Understand UK crypto tax rules for 2025. HMRC guidance, rates, allowances and how to report gains and income from crypto.

Taxation

19/08/2025

How to fill in Box 51 for crypto CGT

Box 51 is now key for crypto in 2024/25. HMRC requires it to split gains before and after 30 Oct’s CGT rate rise, or your tax will be wrong.

Taxation

01/09/2025

How HMRC treats DeFi activities in the UK (2025 update)

How HMRC taxes DeFi lending, staking and liquidity in the UK. Current rules trigger CGT on disposals; proposals may shift to income-only returns.

Taxation

16/09/2025

UK crypto staking tax 2024/25: how to report rewards and gains

Earn crypto through staking? In the UK rewards are taxable income and disposals may trigger CGT. Learn how to report them and use allowances.

We specialise in cryptocurrency bookkeeping

CryptoBooks calculates taxes on your cryptocurrencies with 100% accuracy, giving you the peace of mind of precise tax reports, ready to hand straight to your accountant.

Connect and reconcile all your platforms and wallets

You can connect all your platforms and wallets to CryptoBooks: the already integrated connections exceed 500, both through APIs and CSV. And if you don't find what you're looking for, you can create custom connections.

Monitor and verify your cryptocurrency transactions

Use guided procedures to resolve discrepancies quickly and effortlessly.

Download your cryptocurrency tax reports

Export your cryptocurrency tax reports for your accountant or use them directly in your Income Tax Return, as they are accurate and fully compliant with current UK tax laws