You need a software fully compliant with the Italian law

If you hold cryptocurrencies, you’re required by law to declare them—even if it’s just €1.

The Italian Budget Law 2023 has made this crystal clear, and with increasing EU regulations like MiCA and DAC8, the scrutiny on crypto investors is tighter than ever.

Staying compliant means accurately tracking and reporting every transaction, but without the right tools, this process can feel like an impossible maze. All this can lead to hefty fines.

If you do not declare correctly, you risk heavy penalties

Laws are becoming stricter and controls more frequent

Calculating crypto taxes correctly is a titanic task

You need crypto tax software calibrated to Italian law

You need 100% accurate software or face heavy penalties

Misreporting your crypto transactions—or failing to declare them altogether—can lead to severe consequences. From hefty fines to sleepless nights worrying about audits, the stakes are high. Using the wrong software—or none at all—could leave you with incomplete data, inaccurate calculations, and a tax report that won’t stand up to scrutiny.

You deserve a crypto tax software that delivers precise calculations, ensures compliance with Italian law, and protects you from costly errors.

Misreporting your crypto can lead to severe consequences

Inadequate software leads to inaccurate and indefensible tax calculations

Using an accurate software is crucial for regulatory compliance

Reliable solutions mitigate the risk of financial and legal repercussions

CryptoBooks is the Solution You've Been Looking For

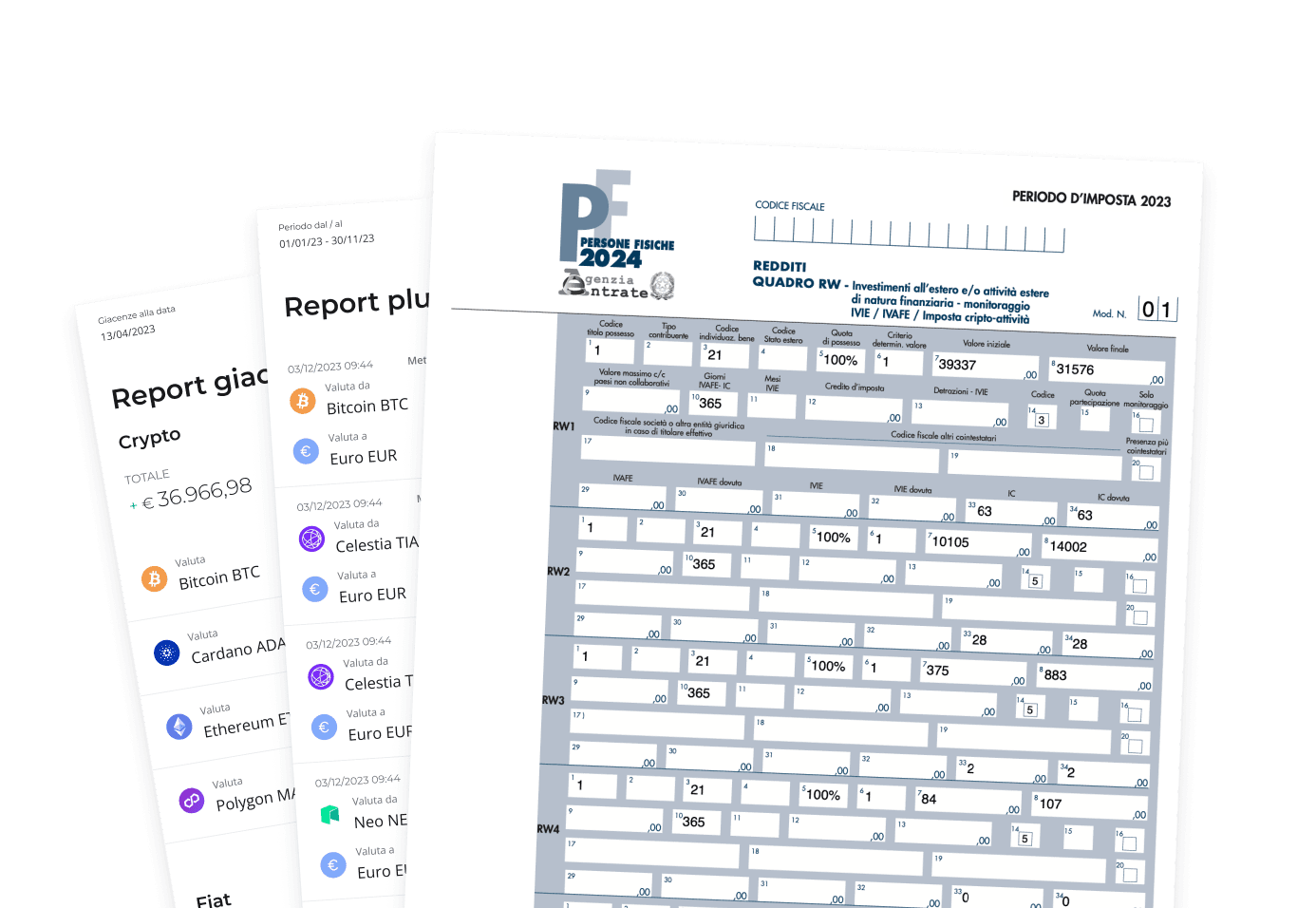

CryptoBooks is the ultimate crypto tax software built to make your tax journey effortless. Designed specifically for compliance with Italian and European regulations, it ensures:

Accurate transaction tracking across all platforms.

Fully compliant tax reports with correct accounting methods.

Error detection and seamless corrections for peace of mind.

With CryptoBooks, you can focus on growing your portfolio while we handle the complexities of crypto taxes. Try CryptoBooks free for 7 days and discover why it’s the essential tool for every crypto investor in Italy.

Choose the perfect plan

for you

There is a plan to suit every need: from those who are just starting out in the world of cryptocurrencies to those who need to report thousands of transactions.

Need more profiles for your family of crypto investors?

Tommaso

The best software

Definitely the best data aggregation software I have tried! Compared to other software it is more intuitive, easy to use, integrated with many exchanges/wallets/blockchains, and any help from a professional to convert .CSV files costs the right amount. With CryptoBooks I also found it easier to fix any misalignments. Communication via e-mail or chat is fast. Highly recommended.

Ale

CryptoBooks best software that helps you calculate your crypto taxes, connect and reconcile your platforms and wallets

After trying about 10 different softwares, I finally found CryptoBooks which I chose as the software to monitor my cryptos and calculate taxes. It allows you to connect to your various exchanges and wallets, optimise transactions and resolve various mismatches, and produce all the necessary documents for tax returns and calculation of taxes due. In Italy, it is the only one I have been able to use to get the data reconciled and the tax reports produced in a reasonable time. Truly recommended!!!

Alessandra S.

Very high level

Serious, fast, precise, professional and above all very knowledgeable. If it wasn't for them, I wouldn't have known how to put things in order and prepare the RW panel. I had heard from several professionals but none of those I contacted were as well prepared as they were. Highly recommended. A special thanks to Paolo for the time he dedicated to me.

Viola

A platform of great help

The optimal solution!!! Simple and intuitive platform. Easy to use even for the less experienced. The few problems were solved with the help of a competent team and its personalised support. All I can say is that I finally feel relaxed about tracking, and ready to declare crypto assets correctly. I recommend CryptoBooks 100%.

Mario

Excellent support

I purchased Cryptobooks a few days ago and, not being very familiar with the software initially, I encountered some difficulties. Fortunately, the customer support was exceptional: Diego in particular was very quick to respond to my emails and solve any problems with great competence and kindness. It is rare to find such prompt and helpful support, which allowed me to get the most out of the software right from the start. I highly recommend Cryptobooks not only for the quality of the product, but also for the excellent customer service.

Filippo C.

I purchased the trader package

I purchased the trader package, and subsequently requested a free consultation. I was followed by Jader, and right from the start I noticed the professionalism, and although I was a little anxious to discuss certain tax issues, Jader was very informal and polite and explained everything I didn't understand with extreme ease. I think it is the best crypto accounting and tax service in Italy. Great Jader, and thanks again for your help.

If you have questions, we have answers

Can I try CryptoBooks before I pay?

Yes! You can use CryptoBooks for 7 days completely free of charge to import your entire cryptocurrency transaction history, view your net capital gains and losses, and monitor your portfolio. Payment is only required when you wish to download and view your complete tax reports. Some features may also be blocked during the free trial.

What differentiates CryptoBooks' plans?

The main difference is the number of transactions the software can account for, which varies from plan to plan. In addition, some specific features are only unlocked in the more advanced plans, such as the multi-profile for 5 users that is only available with the Trader Plus plan.

E se raggiungo il limite di transazioni previsto dal mio piano?

What if I reach my plan's transaction limit?

What is the refund policy?

If CryptoBooks does not meet your needs, you have 14 days to request a refund from the support service. We would then kindly ask you to also send us feedback and tell us what you did not like about the service: it would help us a lot to improve our product!

If I have a discount code, where can I enter it?

If you have a discount code that you can use at CryptoBooks, you can easily enter it during the checkout process: there is a clearly marked field on the page. Don't forget to click ‘Apply’ to apply the discount! The price in the shopping cart will show the discount applied. By completing the payment, you will have used the discount code correctly.

If I am part of a community that has a dedicated feature, which plan should I choose?

CryptoBooks has partnerships with many communities. If you belong to one of them, you will certainly have been provided with the directions to activate the dedicated features. Generally speaking, the procedure requires the activation of a specific code during licence activation, which unlocks the feature linked to the Community. For further assistance, please write to customer.support@cryptobooks.tax!

Are my payment details safe?

100%! CryptoBooks does not keep your data on its servers. Your payment details are held by Stripe, the payment system we use. Stripe is the world leader in online payments and uses the most secure procedures available to ensure that your data is absolutely in good hands.

.png&w=3840&q=75)