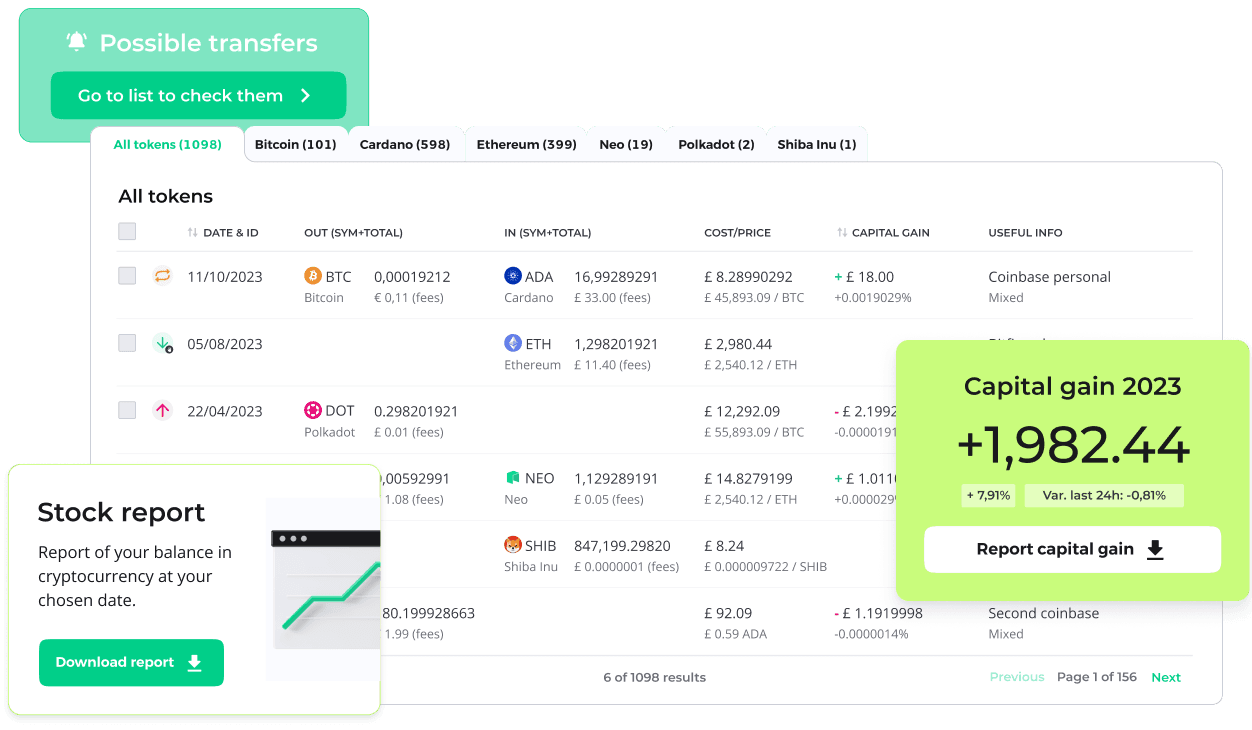

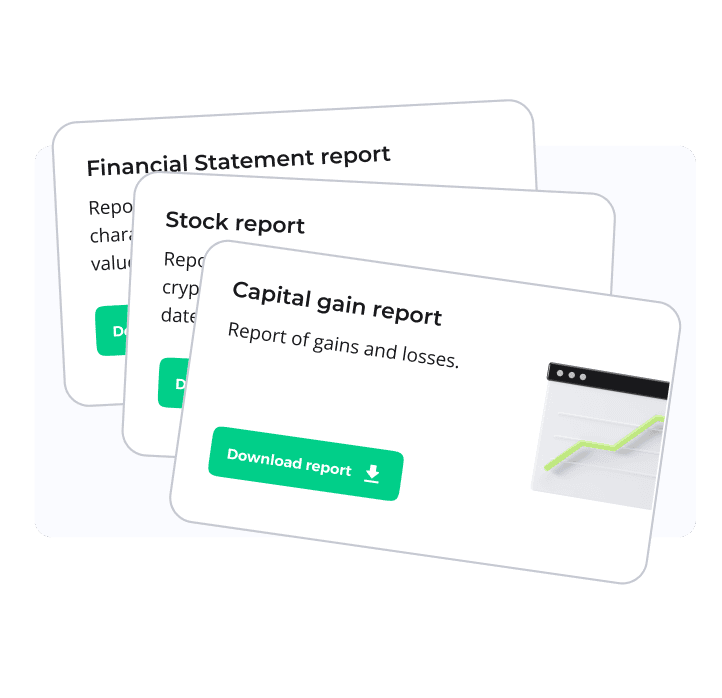

Export precise, ready-to-file tax reports

Our team of experts in crypto accounting has fine-tuned and updates calculation algorithms weekly.

Stock report

Capital gain report

Financial reports

Many other reports

All the tools you need to optimise your crypto taxes

To lower your crypto taxes, you need a clear, up-to-date overview that enables effective tax optimisation.

Asset sale simulator

Tax loss harvesting tool

Visualisation of capital gain/loss positions

Evidence of tax-relevant crypto-to-crypto trades

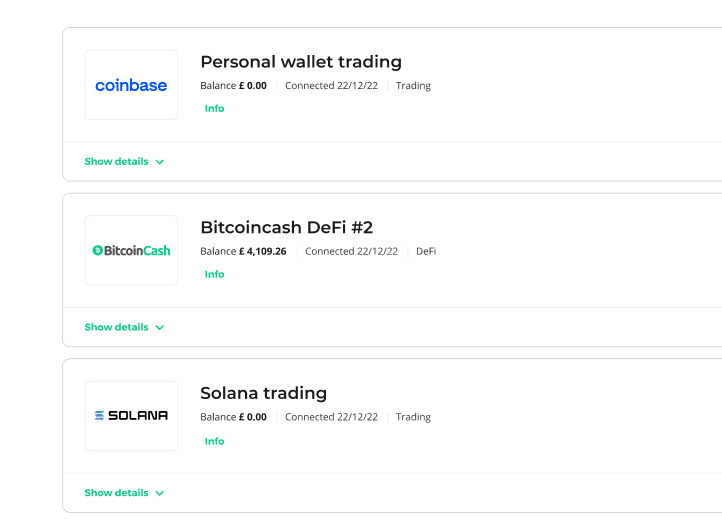

Over 500 integrations for you

CryptoBooks allows you to gather data on your crypto activities and transactions from hundreds of wallets or exchanges. You have plenty of choices.

Import your data with total security and simplicity

CryptoBooks is already integrated with hundreds of platforms, exchanges and blockchains: 100% secure, no private keys required.

Automatic imports

Import via CSV

Custom connections

Single-source management

A portfolio tracker built for full tax visibility and control

CryptoBooks provides you with a comprehensive and advanced portfolio tracker to monitor the performance of your crypto investments on a daily basis.

Performance check tools

Tracking gains and losses by asset

Advanced and comprehensive dashboard

Portfolio breakdown by sources and assets

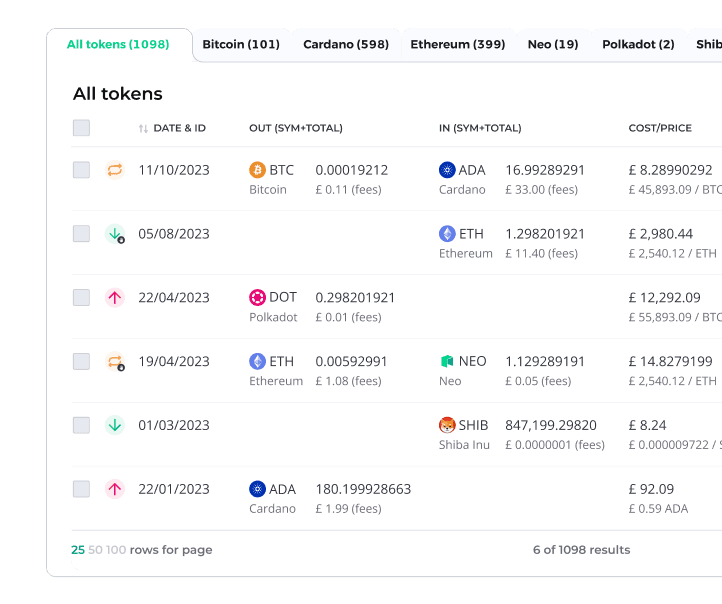

View and manage individual transactions

With the transaction manager, you can edit them manually or apply bulk actions

Edit categories

Manual transactions

Transfer management

Advanced search filters

Transfers, spam, and rounding adjustments are fully managed

We flag any data or tokens that need attention, helping you handle each case with accuracy.

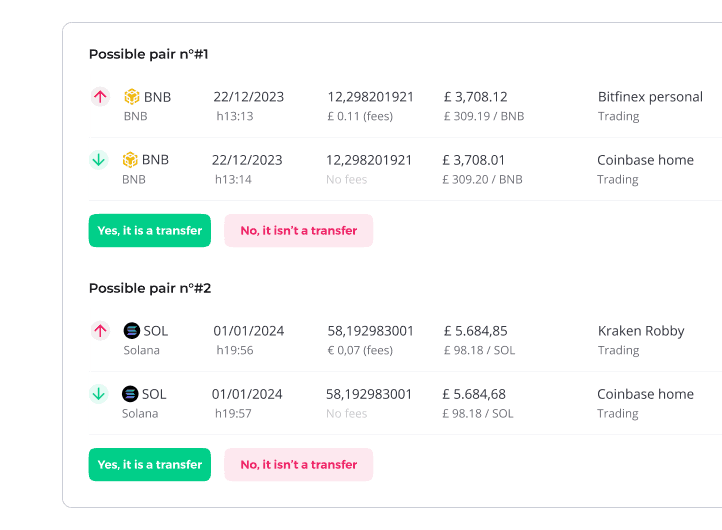

Possible transfer alert

SPAM token alert

Scam token management

Automatic rounding adjustments

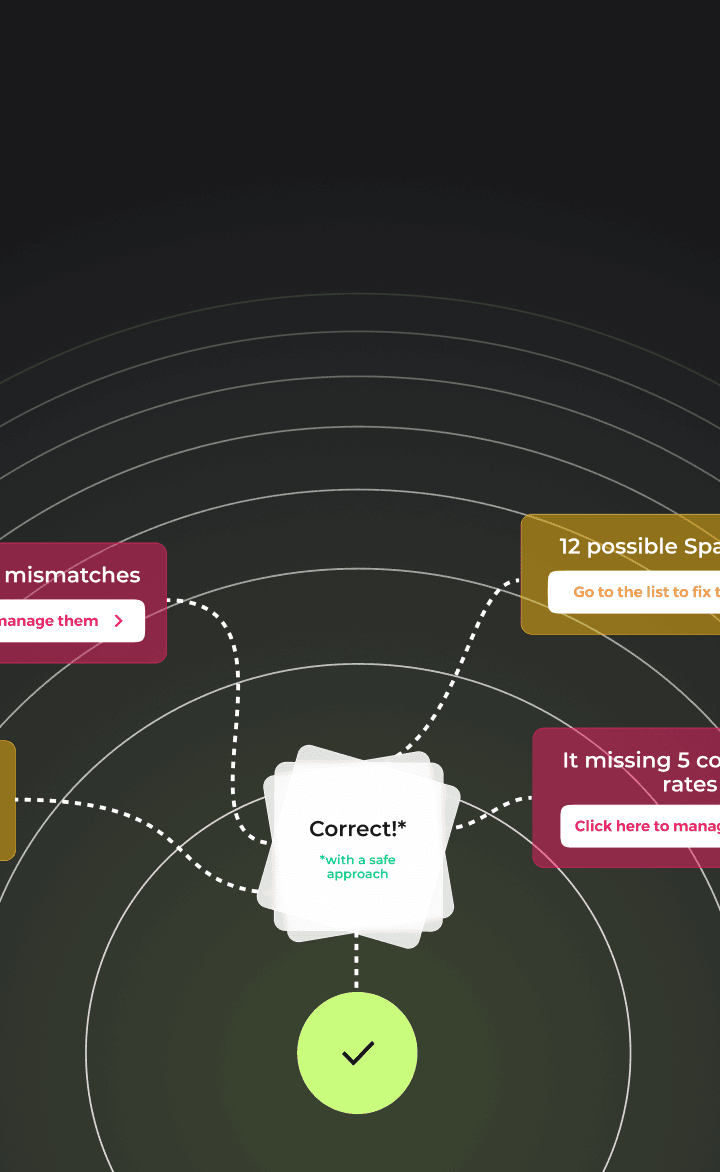

AI-powered crypto tax tools: generate accurate reports in one click

Don’t want to spend time managing data? Let our one-click solution do it for you.

Automatic transfer detection

Auto-resolution of misalignments

Average conversion rates applied

Cautious and compliant approach

Jordan F.

CryptoBooks made my 2023 tax filing seamless. The team really knows UK crypto regulation and helped me optimise gains and losses effectively. Support was quick, clear, and practical. Still my go-to in 2025.

Jasper T.

If you make frequent trades, this tool is indispensable. Tracks everything, calculates accurately and saved me hours of manual work.

Samantha K.

By far the most complete crypto tax software I’ve used. It handled my income reporting flawlessly and updates are always aligned with the latest HMRC guidance.

Seraphina G.

Exceptionally easy to use. CryptoBooks takes the stress out of tax season, especially with clear UK-compliant reports. Support team is responsive and helpful, whether on chat or email.

Imogen B.

Everything I needed to regularise my crypto taxes was right here, I was genuinely happy to find this platform. The interface is intuitive, and the educational content, especially the blog and videos, is a real bonus.

John W.

Consistently reliable. The platform evolves with the rules and translates complexity into practical solutions and the team clearly knows their stuff.

Got questions? We have answers

What features make CryptoBooks better than other software of its kind?

CryptoBooks is designed specifically for the UK and applies HMRC-compliant rules, unlike many tools that rely on generic tax logic. The calculation engine is built to handle cost basis, pooling, and matching rules with precision, ensuring every gain or loss is accurately reconstructed. Transfers between your wallets and platforms are correctly matched to prevent false disposals, an error that can lead to overpaying tax if not handled properly. CryptoBooks helps you pay only what’s due, nothing more. It also detects and excludes SPAM tokens, scams, and irrelevant transactions, handling inconsistencies and rounding issues with advanced logic. When pricing data is missing, it uses average exchange rates to maintain valuation accuracy. Support is another key difference. With CryptoBooks, you have access to a specialised team via chat and email who understand both the software and the tax framework behind it, offering answers that are precise, not generic.

Can CryptoBooks and its AI solve all the issues in my bookkeeping?

Yes. CryptoBooks includes an intelligent mode that automatically handles most of the issues in your transaction history. Once activated, the software detects and fixes errors, assigns exchange rates, matches transfers, and resolves inconsistencies, so you can focus on results, not manual cleanup. If you prefer to review and adjust everything yourself, you can do it at any time. This gives you full control over each transaction and lets you manually manage every detail of your bookkeeping.

There are a lot of features, but how do I know how to use them all?

CryptoBooks offers a wide range of tools, but the platform is designed to guide you through each step with clarity. Ease of use is a priority, and you’re never left on your own. Support is always available via chat or email to help you with any issue. And if you’d rather not manage the process yourself, there’s also a premium service that lets a professional handle everything for you, ideal if you simply want your tax position sorted without having to think about it.

I'm not an expert in taxation; is this software suitable for me?

Yes. CryptoBooks is built to be used by anyone, even if you have no background in tax or accounting. While it offers all the precision and features professionals expect, the interface is simple and guided. You just connect your platforms, follow the steps, and download your reports, accurate and ready to use, with no technical knowledge required.

How does CryptoBooks help me with my tax return and ensure it’s accurate?

In the UK, you’re required to report any capital gains or losses from your crypto activity in your Self Assessment tax return. The tax due varies depending on your personal situation and total gains. CryptoBooks handles all common crypto scenarios, staking, mining, liquidity pooling, farming, airdrops, and more, applying the correct UK tax treatment to each case. You just connect your platforms and wallets. The software reconstructs your full transaction history, applies HMRC rules, and generates a report that shows exactly what data goes where in your tax return, box by box, error-free.

Is the software updated to recent cryptocurrency laws?

CryptoBooks is developed by a team of experts in crypto accounting, with the primary aim of supporting UK taxpayers. It is regularly updated in line with the latest UK regulatory developments, ensuring you remain fully compliant at all times.

How does the free version work?

You can use CryptoBooks for free with no time limit and no credit card required. The free version lets you connect your wallets and exchanges, import and review transactions, manage categories and transfers, and monitor your tax position. To download your official tax reports or unlock advanced features, you’ll need to purchase a licence. Until then, you can explore the full platform and see exactly how it works.